| StockFetcher Forums · General Discussion · Is this a crash or a correction? | << 1 ... 12 13 14 15 16 ... 22 >>Post Follow-up |

| karennma 8,057 posts msg #145553 - Ignore karennma |

12/12/2018 1:51:07 PM Marine2, People who weren't actually IN the market in 1987, 2000 and 2008, don't know what the beginning of a bear market looks like, but I do. I KNOW what it looks like. When experts start talking about inverted yield curves, declining housing prices and global recessions, I become concerned. . . because the same signals repeat themselves again and again. 300+ pt. swings every other day is a BAD sign. A 20% drop in most actively traded stocks in one year is a bad sign. However, I did see a video where Paul Tudor Jones said 2019 would be (his words) quote: "10 for 10"; meaning = FLAT. Basically, a repeat of what I went thru since I bought and held in the latter part of 2017. Everything I bought a year go went up exponentially and went back down to where it was a year ago, leaving me with NO profits and some losses. ... NOT funny .... |

| karennma 8,057 posts msg #145555 - Ignore karennma |

12/12/2018 2:22:36 PM This guy is basically saying the same as PTJ - "10 for 10" .. Okay, so it may not be a crash, but it's still a bear. |

| marine2 963 posts msg #145560 - Ignore marine2 |

12/12/2018 8:31:51 PM We the one’s that have been in the market actively for 40 years like myself know when you have a market that has went up as high as we see it today starting in 2010 to now, we know eventually we will slide back either into a recession or a bear market. That old saying, what goes up must come down eventually. So, you have to get ready for the downturn and be more conservative and not so aggressive. I think, day trading people are having a field day seeing the whipsawing actions happening. For long term investors they better safeguard themselves until the market washes itself down to a bottom that makes sense then, resume its track upward again. Myself, I’m at 50/50 in my investments and maybe that’s too aggressive? If things keep deterioting I may peel back to a 30/70 stance (30% Equities and 70% Bonds and Fixed Income). I know one thing, the Fed Rate Chief better be on HOLD for awhile. He alone could put us into recession. Also, on a positive note, what with China finally blinking and making good changes to its trading rules that will help our country and others get a better foothold into China’s market. |

| karennma 8,057 posts msg #145565 - Ignore karennma |

12/13/2018 7:58:37 AM @ Marine2, Re: "I think, day trading people are having a field day seeing the whipsawing actions happening. " ======================================== This kind volatility is the perfect fantasy for most gamblers, whoops, I mean traders. However, IMHO, you can lose a lot in this type of market because you're trading against computers, NOT other people. The average human can't beat high frequency computer algos. I used to work with a guy who had a PHD in math from MIT. He couldn't do it. When the market turns, Algorithmic trading can be financial suicide. Run the DEATH CROSS (50dma crossing below 200 dma) and see how many of your stocks have been hit. AMZN got hit yesterday. |

| marine2 963 posts msg #145569 - Ignore marine2 |

12/14/2018 2:59:46 AM What’s your plan then? Will you go all cash and sit it out until “the computers” turn positive again? |

| karennma 8,057 posts msg #145571 - Ignore karennma |

12/14/2018 8:35:46 AM I went to cash over a month ago, when I first started posting this thread. But of course, it was too late. At one point, I thought the market was rebounding, but then, I remember 1987, 2000 & 2008. The same sh*+ happened in the Spring (April 2018) (see my posts and warning). 300+ pt swings ev. other day just don't add up. In fact, I believe in March or April, we had a 1000 pt. drop. ** NOT "NORMAL" **! I don't know how anybody who's been watching the markets a long time can think that a 200-300pt move at the open is "normal". I've clearly stated several times, I thought the top was Jan 2018 when the market began cratering. If I'd stayed out then, I'd have a lot more cash than I do now. I don't have the stamina to stomach this kind of volatility. It's algo-trading -- to make people lose money. When losing money becomes the hobby, it's time to quit. |

| davesaint86 726 posts msg #145573 - Ignore davesaint86 |

12/14/2018 10:52:04 AM Look at Chart 57 https://stockcharts.com/public/1107832/tenpp/5 |

| karennma 8,057 posts msg #145578 - Ignore karennma |

12/15/2018 12:50:19 PM chart 57? Yeah, I know. Posting LATE as usual. They should've told people this sh*+ 2 months ago. Here's what I said TWO MONTHS AGO ... Xxxxxxxxx 1,710 posts msg #144939 - Ignore Xxxxxxxx 10/12/2018 1:09:35 PM I like what Kudlow had to say this morning. Its a normal correction in a Bull Market. ============================== karennma 7,147 posts msg #144968 10/16/2018 10:36:01 AM But did you also hear the precursor to Kudlow's statement? He said, "Liz Ann Sonders knows more than I" .... LAS said this is the tail END of the bull market. No sh*!+!! Yep. Liza Ann Sonders knows and here's what she had to say this week -- ... You were warned two months ago! |

| Cheese 1,374 posts msg #145579 - Ignore Cheese |

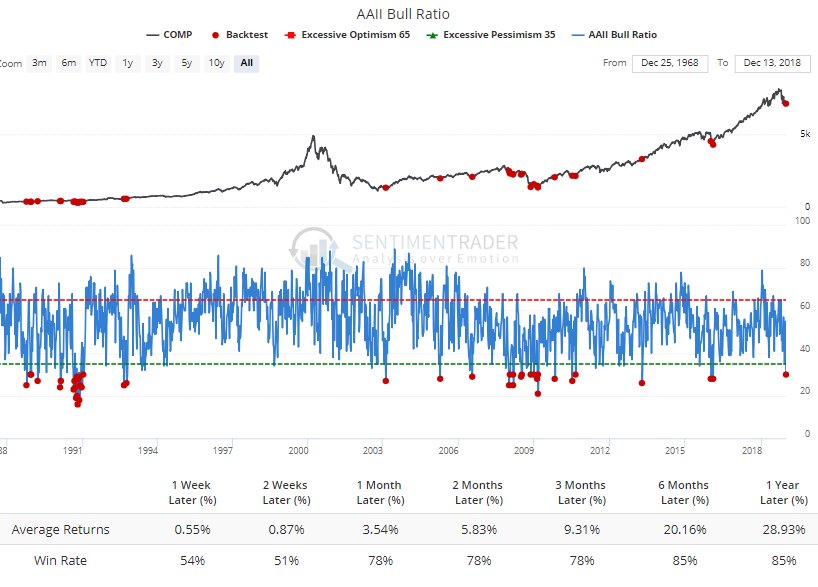

12/15/2018 8:12:17 PM @karennma On Dec 13, 2018 Liz Ann Sonders @LizAnnSonders re-tweeted the following from SentimenTrader @sentimentrader According to the Backtester, when Ma & Pa have gotten this despondent, tech stocks rallied an average of 29% over the next year.

Previously, on Apr 12, 2018 LAS re-tweeted the following from SentimenTrader @sentimentrader This is what happens when mom & pop become pessimistic during an uptrending market.

So, if we were to believe the above Dec 13 tweet and re-tweet, we could see higher levels for tech stocks in Dec 2019, higher than the current correction levels of Dec 2018. Better yet, if we were to believe the above Apr 12 tweet and re-tweet, we could see higher levels for tech stocks in Apr 2019 that could be higher than the high levels of Apr 2018 (higher than the correction levels of Dec 2018.) Maybe we could believe in the American spirit and tech innovation, and watch for a bottoming process amidst a thousand points of lights. |

| snappyfrog 749 posts msg #145580 - Ignore snappyfrog |

12/16/2018 9:14:19 AM As a swing and options trader, this volatility is great. Stocks and ETFs swing up and down every day, week and month. I don't short stocks, but I do play inverse ETFs along with playing options in both directions. There are always plays available every day. Do I take losses, absolutely. But, even in a down market there are numerous ways to make money. |

| StockFetcher Forums · General Discussion · Is this a crash or a correction? | << 1 ... 12 13 14 15 16 ... 22 >>Post Follow-up |