| StockFetcher Forums · General Discussion · Stan Weinstein's Secrets For Profiting in Bull and Bear Markets | << 1 ... 5 6 7 8 9 ... 11 >>Post Follow-up |

| volvlov 32 posts msg #148739 - Ignore volvlov |

7/31/2019 1:43:06 PM I sense a shift from gold and semi-conductors to energy and medical. Anyone else? |

| graftonian 1,089 posts msg #148741 - Ignore graftonian |

7/31/2019 3:10:49 PM Indeed, gold is losing its glitter |

| Mactheriverrat 3,178 posts msg #148742 - Ignore Mactheriverrat |

7/31/2019 3:21:10 PM Powell speaks and everything takes a dump- |

| nibor100 1,102 posts msg #148744 - Ignore nibor100 |

7/31/2019 7:52:36 PM @Mactheriverrat, When I posted the data regarding the starting dates of Stage 2 runs in the book, I was just showing facts and was actually glad that he had some charts from many different years. I was not intending to be negative regarding the book due to its age, a good idea is a good idea no matter how old it is. I just wish I had bought it when it was written,,, @karenma, I guess foreseeing Stage 3 depends on what you mean by foresee, Generally, a Stage 3 is forming when the 30 week moving average starts to flatten out instead of rising, and the Mansfield relative strength line does the same or starts to descend. There are a couple chart patterns and trend line observations he uses as confirmation; but most of that are observations as the stock, sector, or market enters a Stage 3, not really forecasting ahead of time. He is a big believer in Stops for protecting profits which makes me believe he doesn't feel he can foresee Stage 3s and 4s well enough to not use Stops. Ed S |

| Mactheriverrat 3,178 posts msg #148746 - Ignore Mactheriverrat modified |

8/1/2019 11:42:21 AM @ED There was no offense taken. Weinstein's theory is good idea consider that his book 31 years old or older. Back in 1988 there was very little online trading for the average Joe. Things have come a long way. As far as OSTK was a stock at the resistance line even if its just starting its stage 2. Still studying stocks on their initial breakouts vs continuation breakout. Plus stocks that have had their initial breakouts and really start to gain uptrend strength. |

| karennma 8,057 posts msg #148747 - Ignore karennma modified |

8/1/2019 12:06:48 PM Mactheriverrat 2,077 posts msg #148742 - Ignore Mactheriverrat 7/31/2019 3:21:10 PM Powell speaks and everything takes a dump- ====================================== Seems yesterday was a temporary blip - or "glitch", as Prz Trump would say. Honestly, at this point, I can't believe a correction hasn't started. It's August! |

| Mactheriverrat 3,178 posts msg #148748 - Ignore Mactheriverrat modified |

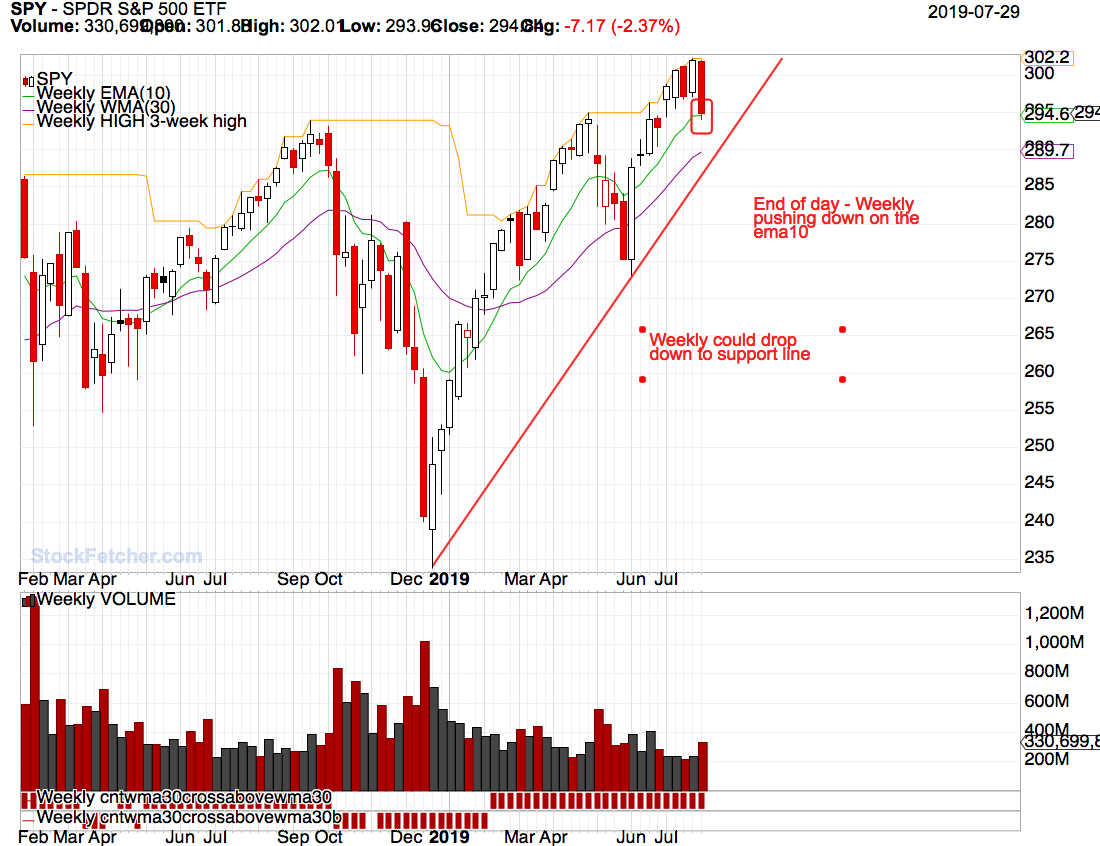

8/1/2019 12:50:53 PM @karen You would think as I hate days like yesterday as they usually pull a lot of other stocks down with the markets knee jerk reactions only to more or less bounce back. weekly spy  daily spy  One note here IMHO one can see back in real early in oct of 2018 how the daily and the weekly really start show of the market was fixing to have a correction. |

| karennma 8,057 posts msg #148753 - Ignore karennma |

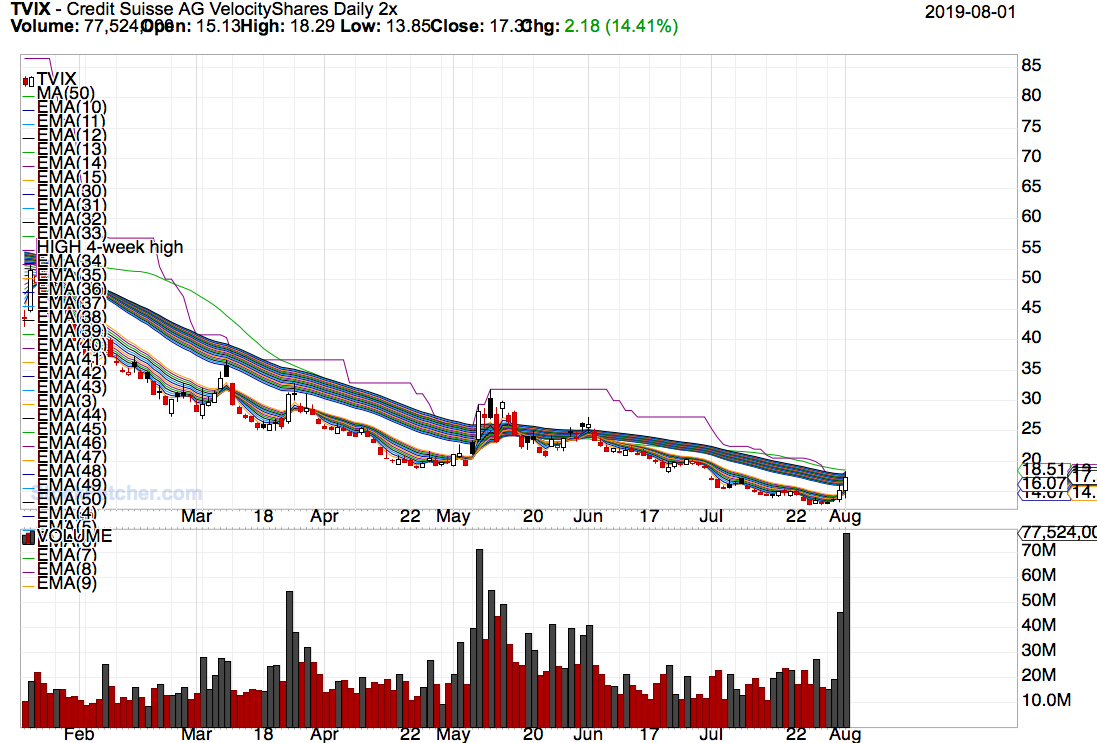

8/1/2019 2:32:28 PM @ Mac, Tee hee hee Look at the VIX chart. THIS makes sense. Guppy turned short on SPY. |

| Mactheriverrat 3,178 posts msg #148758 - Ignore Mactheriverrat modified |

8/1/2019 9:15:35 PM @karen    |

| Mactheriverrat 3,178 posts msg #148759 - Ignore Mactheriverrat |

8/1/2019 9:40:15 PM Well looks like Gold and silver isn't dead yet. |

| StockFetcher Forums · General Discussion · Stan Weinstein's Secrets For Profiting in Bull and Bear Markets | << 1 ... 5 6 7 8 9 ... 11 >>Post Follow-up |