| StockFetcher Forums · General Discussion · Hi Y'all ... | << 1 ... 2 3 4 5 6 ... 9 >>Post Follow-up |

| Cheese 1,374 posts msg #158729 - Ignore Cheese |

3/4/2022 9:10:31 PM https://www.stockfetcher.com/forums/General-Discussion/Hi-Y-all/158432/20 =============================== Thanks, karennma. Still not a good time. Some bear markets might last 6 months to 2.5 years. |

| Mactheriverrat 3,178 posts msg #158731 - Ignore Mactheriverrat |

3/4/2022 11:15:25 PM Seems there are some good uptrends in Sector(Oils-Energy) |

| klynn55 747 posts msg #158733 - Ignore klynn55 |

3/4/2022 11:26:40 PM market going down is strange to dem presidents, note clinton's 208% sp gain, note obamas sp 500 gain of 128%, the pandemic and russia cant stop joe ! |

| Cheese 1,374 posts msg #158734 - Ignore Cheese |

3/5/2022 11:49:21 AM https://www.stockfetcher.com/forums/General-Discussion/Hi-Y-all/158432/30 ===================================== THANK YOU @Mactheriverrat and @klynn55. Now, in more practical terms, let's review what John once wrote about EMA(60): ...If price can move the downtrending EMA(60) then it can move more. Sometimes the uptrend may be short lived... ...Short term averages crossing over longer term is a buy but trend should be confirmed. Price should be crossing above a downtrend line... EMA(60) of Guppy GMMA |

| Mactheriverrat 3,178 posts msg #158735 - Ignore Mactheriverrat |

3/5/2022 1:13:03 PM Your Welcome Cheese!!! |

| karennma 8,057 posts msg #158736 - Ignore karennma |

3/6/2022 8:42:53 AM Re: XLE and XOM ... "#2 - President's lack of economic growth policy. (i.e., shutting down U.S. gas pipelines, cargo ships/container shipping, small businesses, etc.) The uptrend coincides with Biden's energy policies. Remember that every time you fill up your gas tank. Also, remember, economic policy precedes moving averages. The crystal ball is economic policy, not MAs. |

| Cheese 1,374 posts msg #158737 - Ignore Cheese |

3/6/2022 11:39:53 AM By their calculation process, moving averages are lagging indicators. Moving averages are among the most useful trend indicators. By definition, trend following is behind the curve. Some smart posters in this forum seem to follow trends. |

| Mactheriverrat 3,178 posts msg #158738 - Ignore Mactheriverrat modified |

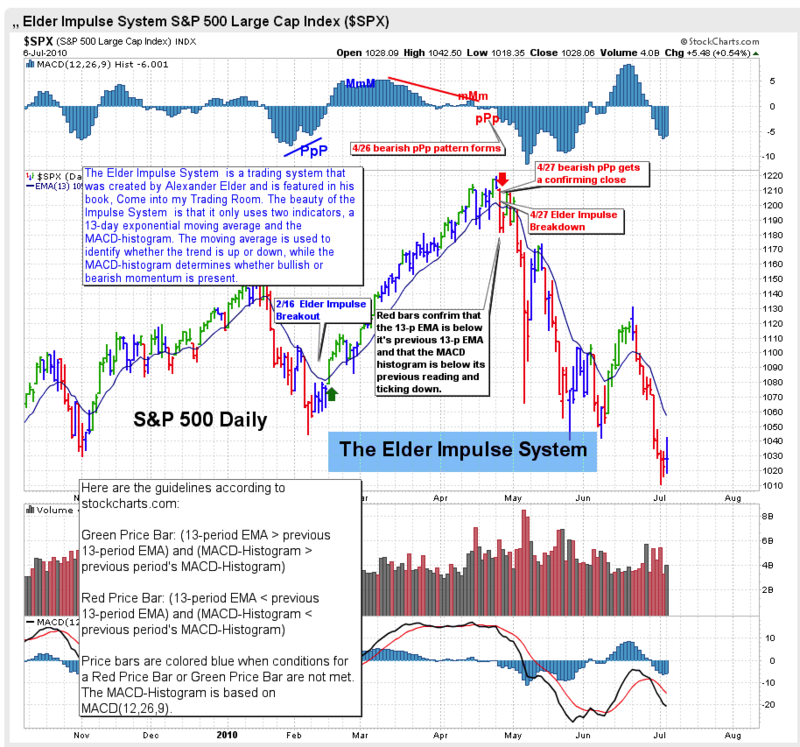

3/6/2022 1:36:42 PM Sector(Oils-Energy) Using the Elder Impulse System. Since Stockfetcher doesn't have the Elder Impulse System setup up you can use another free charting service like stock charts.com and setup up the candles to show Elder Impulse System. Submit  |

| Mactheriverrat 3,178 posts msg #158739 - Ignore Mactheriverrat |

3/6/2022 1:51:50 PM XOM from that filter looks like a good breakout. |

| klynn55 747 posts msg #158740 - Ignore klynn55 |

3/6/2022 4:52:48 PM and how did biden's policy cause this: "Global oil consumption bottomed out at about 70% of pre-pandemic levels in what became known as the “Black April” of 2020. By the third quarter of that year, when a degree of normality had returned to many nations as the first wave ebbed, that figure was 90%. " karen is opposing and oversimplifying a very complex issue. energy is worldwide, and future buyers also have a great impact on prices. |

| StockFetcher Forums · General Discussion · Hi Y'all ... | << 1 ... 2 3 4 5 6 ... 9 >>Post Follow-up |