| StockFetcher Forums · General Discussion · Hi Y'all ... | << 1 2 3 4 5 ... 9 >>Post Follow-up |

| marine2 963 posts msg #158461 - Ignore marine2 |

1/25/2022 11:26:14 AM Looking at it with rose shaded glasses sure we could be in a typical cyclical environment but, things change drastically IF we get into a war with Russia, and China decides to move on Taiwan. What with how our economy is changing along with world relations deteriorating I think cold hard cash might be our only savior in saving our wealth. Let’s just hope Biden and his people use the right kind of diplomacy that will turn Putin around. Let’s hope and pray. |

| karennma 8,057 posts msg #158462 - Ignore karennma |

1/25/2022 9:28:19 PM @ marine2, Re: "What with how our economy is changing along with world relations deteriorating I think cold hard cash might be our only savior in saving our wealth" ===================================== And IF your money is devalued and subsequently digitized, holding "cold hard cash" won't do you much good. James 5:3 "Your gold and silver are corroded. The very wealth you were counting on will eat away your flesh like fire. This corroded treasure you have hoarded will testify against you on the day of judgment. |

| karennma 8,057 posts msg #158468 - Ignore karennma |

1/27/2022 5:31:03 PM https://www.msn.com/en-us/money/markets/jeremy-grantham-says-the-current-plunge-in-stocks-looks-like-the-crash-that-triggered-the-great-depression/ar-AATcajE?ocid=msedgntp Yep. IMHO, we're at the point of no return. |

| marine2 963 posts msg #158473 - Ignore marine2 |

1/29/2022 12:43:21 PM I did read a positive the other day in “Market Watch” online that showed two charts showing the performance of the market in the “NYSE” and “NASDQ” relative to when the “FEDS” lower interest rates and when they begin raising interest rates. They showed where, in different time periods, these interest rate changes that the markets actually do better % wise when the “FEDS” raise interest rates opposed to lowering interest rates. Those two charts surprised me but made me feel that things will be ok in the markets if rates rise. |

| Mactheriverrat 3,178 posts msg #158475 - Ignore Mactheriverrat |

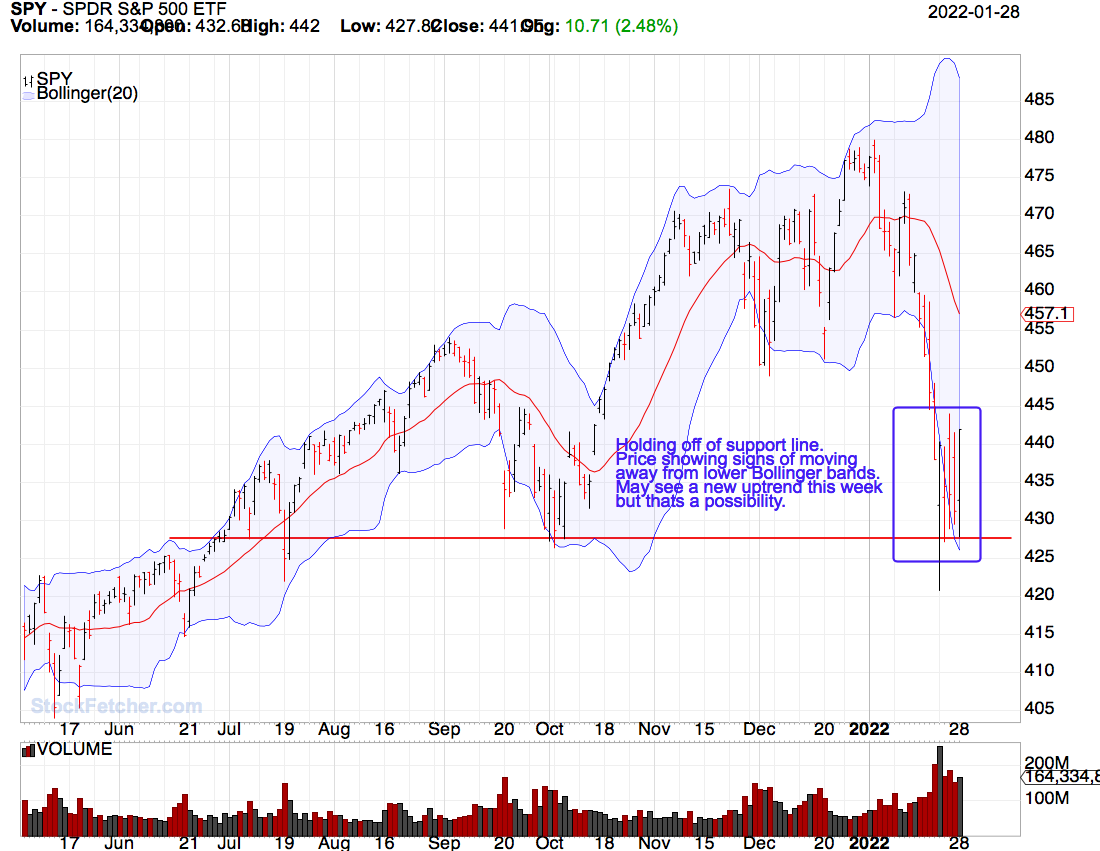

1/29/2022 1:13:51 PM |

| Mactheriverrat 3,178 posts msg #158476 - Ignore Mactheriverrat |

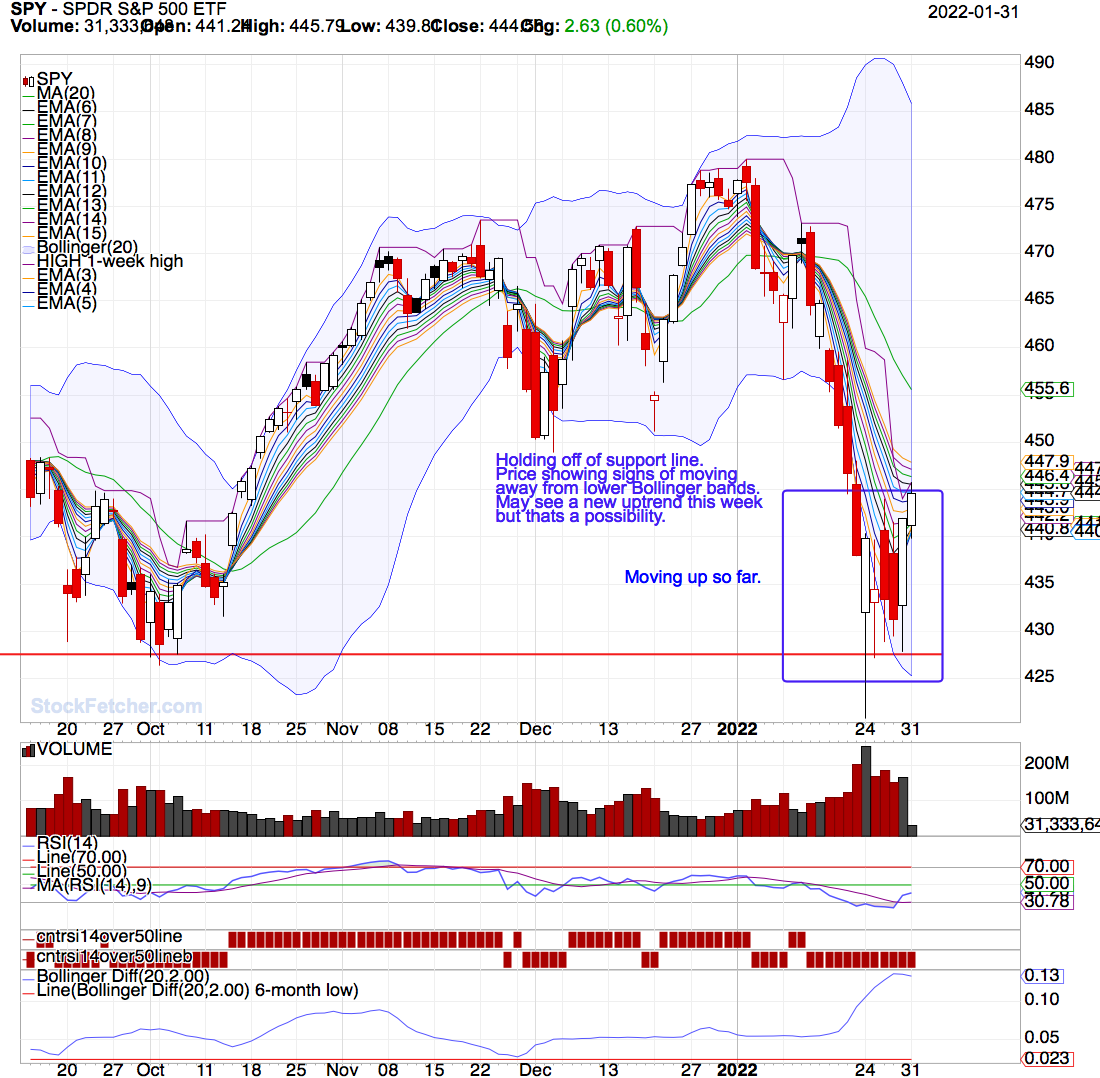

1/31/2022 11:02:42 AM |

| Mactheriverrat 3,178 posts msg #158485 - Ignore Mactheriverrat |

1/31/2022 8:42:56 PM and more stocks after having re-set are showing up on scans.  |

| Mactheriverrat 3,178 posts msg #158507 - Ignore Mactheriverrat |

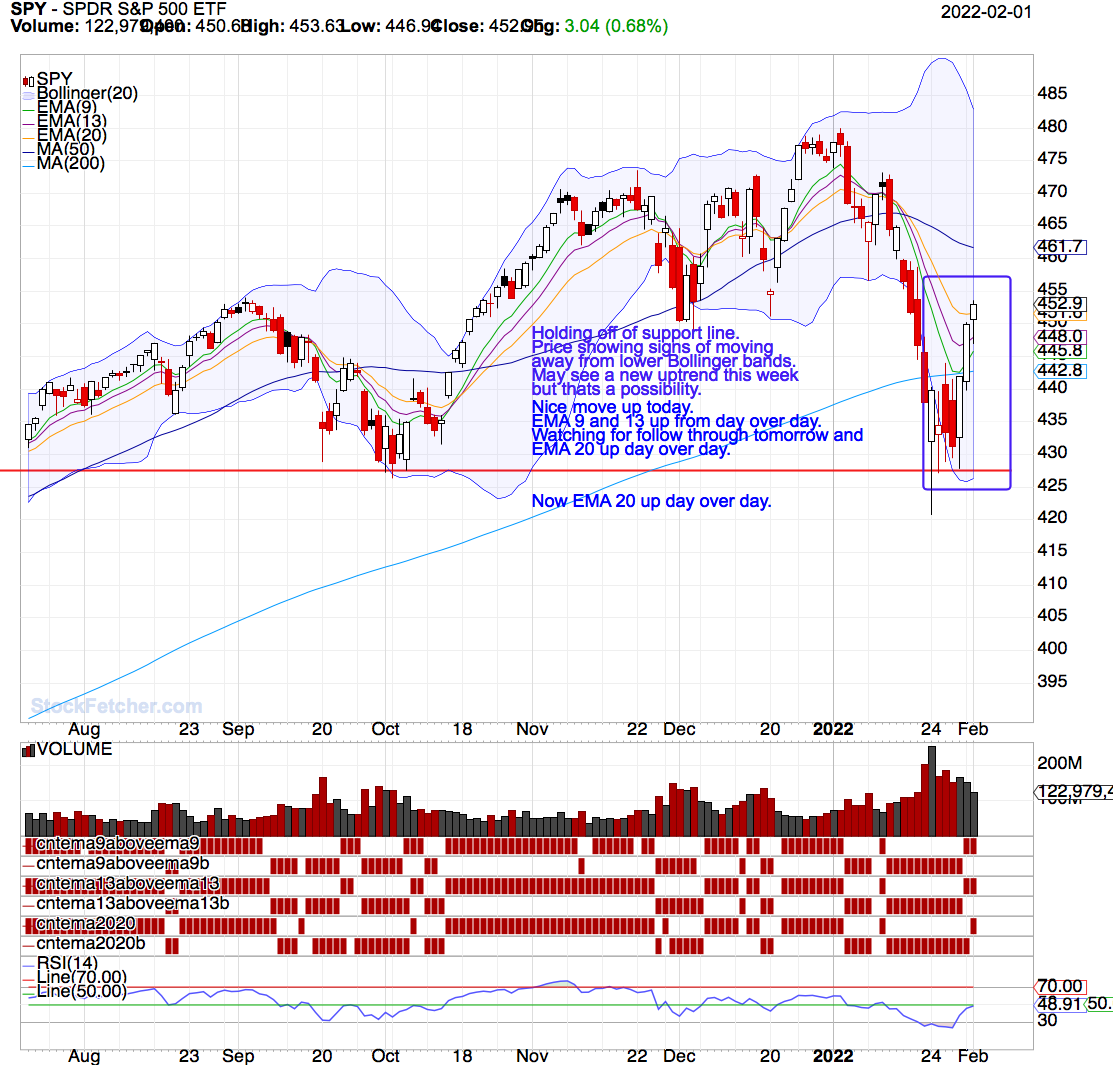

2/1/2022 10:20:17 PM |

| snappyfrog 749 posts msg #158511 - Ignore snappyfrog |

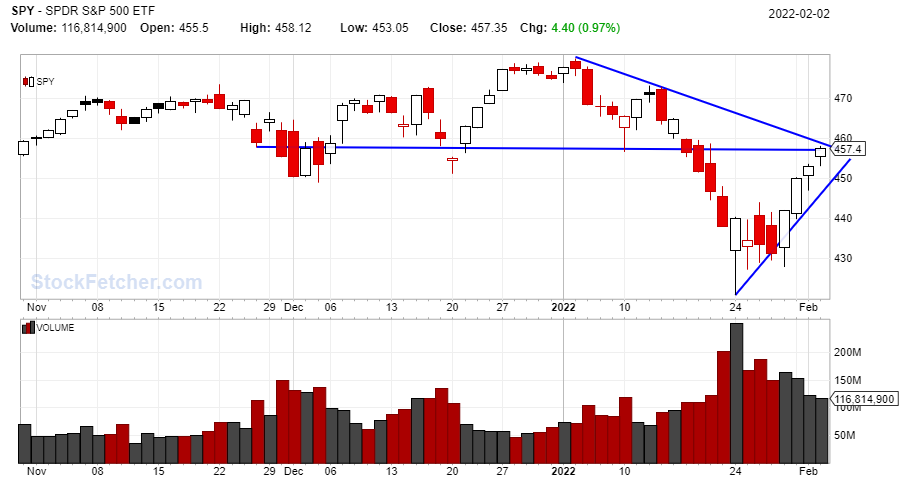

2/2/2022 7:29:55 PM We are at a precarious position. We either break out to the upside and run or we fail at this resistance area and break out to the downside through the trend line. Will be interesting to see what happens here.  |

| marine2 963 posts msg #158514 - Ignore marine2 modified |

2/3/2022 12:11:52 PM Today it looks like SPY is running out of steam and falling back now. Might be a temporary lag or maybe looking to retrace backwards to its previous low. Anyone’s guess at this point since we still have Russia, China, and interest rate hikes to worry about. I guess, keep your powder dry and look for quick opportunities to turn a few dollars into more dollars. Good luck in your investing endeavors. |

| StockFetcher Forums · General Discussion · Hi Y'all ... | << 1 2 3 4 5 ... 9 >>Post Follow-up |