| StockFetcher Forums · Stock Picks and Trading · Picks and Pans Since Jan 2020 | << 1 ... 18 19 20 21 22 ... 29 >>Post Follow-up |

| sandjco 648 posts msg #152982 - Ignore sandjco |

7/6/2020 11:44:20 AM This is absolutely nuts...TSLA $1300 now...another grand slammer using July options.  Time to ride the escalator down perhaps soon...bruh. |

| sandjco 648 posts msg #153009 - Ignore sandjco |

7/7/2020 3:34:27 PM Out of TSLA calls for now. Out of NKLA puts. |

| sandjco 648 posts msg #153025 - Ignore sandjco |

7/8/2020 5:15:12 PM Back to WORK...pun intended ;=P  BABA'd up...drunk as a skunk....  Can't believe it will almost be 200 posts! When it hits 200; will be posting intermittently only and go back to lurking! Yep...it is still going up. When will it go down? Who knows? Don't care...music still playing! |

| sandjco 648 posts msg #153053 - Ignore sandjco modified |

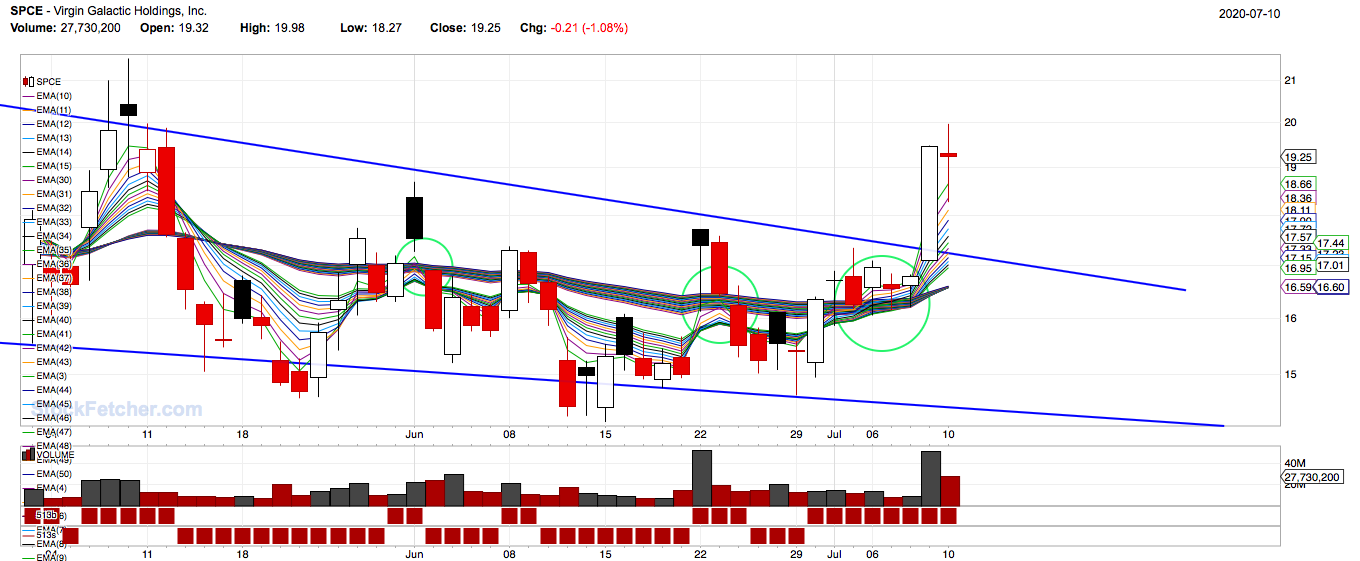

7/9/2020 11:02:46 PM Houston ....do we have liftoff? Major Tom.. will add another tranche when it breaks $22.  7/2/2020 11:46:20 AM TSLA breaks $1200! Now the biggest auto maker by market cap! Exceeds delivery target. Thanks Uncle Elon and the shorts! Please do come back and play another day! WKHS still running. Out of BYND already. GRAF wts. BLDP is running. Looking for SPCE to break anytime soon. |

| sandjco 648 posts msg #153065 - Ignore sandjco modified |

7/11/2020 10:19:31 AM And it keeps chugging along with no care in the world....which continues to baffle a lot of people that i get into interesting discussions with. My response has always been...why does it matter if you are making money? But but but...it will crash soon!!!! I tell them...that is like waiting the wonderful night with a hot babe to end instead of enjoying it. When it ends...you will know but will you listen? Apparently, if you took away the "heavy hitters" (FANG), the market would look different. While I have zero doubt about that logic...makes me wonder what is the point or does it really matter (because obviously, since the March lows...it has been proven that is doesn't really matter)?   Cleary (for a newbie), it seems the world is geared towards the "new economy" (QQQ's) and the old world is being left behind; COVID was the coming out party. I'd say, take the tech behemoths out of SPOO and DIA and the picture is clearer. The paradigm should be...if you want growth...look no further than going long on QQQs (and yes, it will always come with the baggage of being "volatile").  "FUNdamental" analysis techniques based on the ol Benjie methods will now have to be recalibrated? Good luck using this method to find the next TSLA or NFLX or NVDA or AMZN or... My take away for my kids..."Don't be trapped by dogma - which is living with other people's thinking" (S. Jobs). So very glad I moved on from "Advisors" who made money based on assets and got paid regardless of performance (yes, there may be some good ones out there). Technical analysis does indeed work and allows you to play long or short...your biggest nemesis is yourself; figure your own demons out and you got it half figured out! Kids...you are only as good as your last trade; hubris can cut you down as quick as you've built your chips up. The music doesn't stop till the DJ stops spinnin. Till then, enjoy the dance! edit: who would have thunk that a US passport is now (temporarily) worthless in some parts of the world...weird right? |

| shillllihs 6,102 posts msg #153066 - Ignore shillllihs |

7/11/2020 1:32:59 PM You are like the George Plimpton or George Will of SF. Why isn’t this thread a beehive of activity? |

| sandjco 648 posts msg #153069 - Ignore sandjco modified |

7/12/2020 12:32:13 AM LMAO thanks Shills! Umm...it is a boring thread; no secret sauce....no drama! Just picks to pay it forward. I think I have more than accomplished that part. I can't code for beans and i have no mechanical entry/exit scripts. Super admire those who have posted here consistently over the years. Definitely requires effort and time. I'm amazed that 580 plus entries later I am still learning. |

| ron22 255 posts msg #153070 - Ignore ron22 |

7/12/2020 11:49:34 AM @sandjco, What is your favorite filter? How do you determine what stocks to add and/or delete from your watchlist? I appreciate your reply as well as all of your informative posts. I am still learning. |

| Mactheriverrat 3,178 posts msg #153071 - Ignore Mactheriverrat |

7/12/2020 2:13:56 PM Barring a market selloff this should run .  |

| sandjco 648 posts msg #153074 - Ignore sandjco |

7/12/2020 9:41:55 PM @ron22 and @Mac...thank you both for dropping by! @Mac...this will be the third attempt for "lift off"; have been patiently accumulating it. Good luck if you have a position in it.  @ron22 - I don't really have a "favourite" filter per se. It may sound weird but if you check out my earlier thread, I was so into the RSI2 thing. It was great till it doesn't work anymore (e.g. XIV - albeit black swan, or the recent March meltdown, or stocks on an extended run). It made me realize that "I" should not really put too much emphasis on a "fave filter" or "fave indicator". - I really like or strive to have simple charts. Mac has been a super huge influence (funny how he happened to post here today) on me with Guppies (I still don't think I have fully digested it yet but got the basics). Kevin, Xarlor, KSK8, Chetron, graftonian, Safetrade, TRO, Nibor, four, snappy...just to name a few have been huge in my journey. - I "try" not to read news or look at ratios (yes, I used to be a fundamentalist); I try to have the picture tell me a story. This is a struggle! - I "try" not to have a "watchlist"; i narrow my filter search to what I am naturally drawn to - tech and trade the names I am familiar or can relate to. This is what I have been using lately; I added the EMA5/13 cross recently from one of Mac's posts. This is all Mac's influence. Hope the above helps. So, what about you ron22; do you have a "go to" script if you don't mind sharing and how do you look for plays? |

| StockFetcher Forums · Stock Picks and Trading · Picks and Pans Since Jan 2020 | << 1 ... 18 19 20 21 22 ... 29 >>Post Follow-up |