| StockFetcher Forums · Stock Picks and Trading · Picks and Pans Since Jan 2020 | << 1 ... 24 25 26 27 28 ... 29 >>Post Follow-up |

| dashover 229 posts msg #153567 - Ignore dashover |

8/14/2020 10:59:45 AM Sandjco, I am doing horribly trading weeklies. I jump from trading reversions to breakouts. In the money to just out... Some debit spreads. It's a mess Could you review your overall approach for short term option trading. Thanks!! Dash |

| sandjco 648 posts msg #153568 - Ignore sandjco modified |

8/14/2020 11:03:50 AM testing 123 |

| sandjco 648 posts msg #153573 - Ignore sandjco modified |

8/14/2020 12:35:45 PM Hi dashover! Thanks for dropping by! RE: horribly doing weeklies remember this from one of your old posts? 2/6/2013 9:50:37 PM 20 years and sadly I'm still looking for the better approach , so I can stop looking and simply marry it BUT what if, along the way, you actually have already found one or a few but for whatever reason you thought there was something "better" just because someone else appeared to be doing better with their "system"? Keep in mind i am NOT an OPTION expert or an expert on anything. I do not know much about you or your style so here are my general thoughts: You won't like my answer but I do hope it will lead you to the right path... 1. you need to find out who you are (see my original thread as someone else told me this indirectly). edit: if you are more of a "swing trader"...outright weeklies may not provide u cushion. Maybe Calendars? 2. Is your weapon of choice aligned with your risk tolerance? For example, weeklies MAY NOT the optimal weapon to use if you get freaked out with 30% or 40% dips or expect > 200 % gains on them (they are nice but...). I look at weeklies purely as a substitute to day trade indexes and sometimes stocks (like the recent plays) and I do not use SF filters for them at all. AAPL is trading at $453 as I type...I am in for next Fri 460C. I would be happy to be able to scalp a few thou on a few contracts for the day. What SF filter have u used over the years that gave you more success than any other? Why did u stop using it? In my journey (as short as it is)...I didn't find the holy grail...but I discovered "me" and how I wanted to trade the market. Hope the above makes sense. |

| Cheese 1,374 posts msg #153575 - Ignore Cheese |

8/14/2020 1:25:29 PM @dashover @sandjco I know that dash;s query was to sandjco but I would like to give my inputs to dash out of gratitude because I have been using dash's whyisthemarketup every day. I hope you guys don't mind Also, I don't use options or shorts, so I don't have any trading expertise to offer. I just want to mention this site https://twitter.com/tradeciety to dash. A lot of rolf's material is useful, user friendly, and still free. Some of the good old info was removed to keep his account fresh and uncluttered, I hope you will find some of his free stuff useful. Happy trading |

| sandjco 648 posts msg #153576 - Ignore sandjco modified |

8/14/2020 1:26:12 PM @dash.. sorry, ADD tendencies! Closing AAPL contracts of the 460C for a quickie. Calling it a day. RE: I jump from trading reversions to breakouts. In the money to just out... Some debit spreads. It's a mess My suggestion: - apply those fave scripts to just a few core stocks - to get your mojo going...stick with ATM 3 months out (that how i started) instead of chasing the whale? Thanks to Xarlor, I am slowly learning Calendars and Wheels ... @cheese! of course; I don't mind!!!! thanks for dropping by! And you sir or ma'am have a LOT to offer; you are just always humble!!! edit: now specifically, on why AAPL today. - I have 5M chart on one screen and 15M on the other while 3rd and 4th monitor have SF and Brokerage - I do not trade on the 1st 15M; just watching. Almost everything was red on my watchlist - AAPL just happened to catch my eye (1st ticker) that was bumping along the EMA 10/60 cross. - EMA 10 did not cross EMA 60 despite price crossing below EMA 60 - around 8AM PST, it wanted to drop below 452 but did not so mentally, my trigger was 453 and low balled the 460C for next Friday. - didn't look like it was going to pierce 460 for the day; decided to bail for a decent scalp as I have to do errands and cannot watch. I was happy with the scalp and will not look back (try not to). Xarlor would give me crap if I did that! The above hopefully gives you my thinking....i don't think it could be coded as I have always said I am a "visual"/gut feel kinda guy... TRUTH be known...i was gonna shut this blog today and was posting my goodbye's when dash came for a visit lol! |

| sandjco 648 posts msg #153578 - Ignore sandjco |

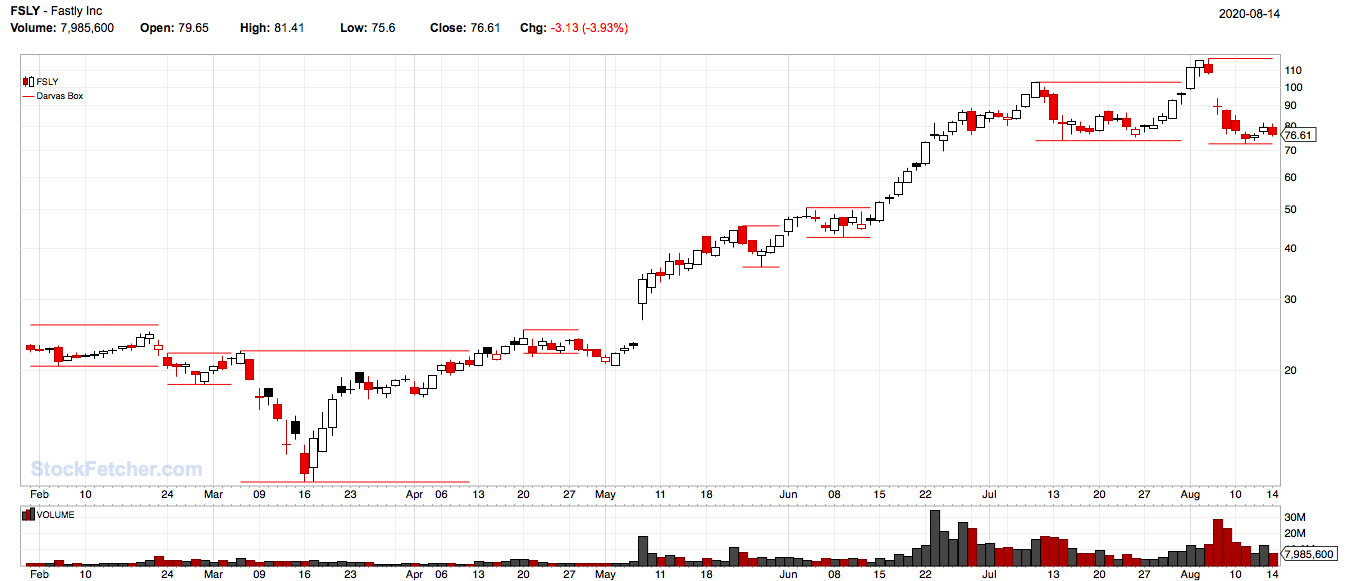

8/14/2020 2:03:21 PM Adventure into covered calls! Yesterday, I bout FSLY at $79.30 and sold 87C Aug 21 for $1.75. My gut told me to pick the 85C but my brain went AWOL. My goal for this real money experiment will be to see: - how selling covered call reduces my ACB while waiting for the next run - what actually happens when it is "called" (I mean kinda crazy...but just wanted to see it!) So far, stock dropping partially covered by calls lowered value. |

| sandjco 648 posts msg #153580 - Ignore sandjco modified |

8/14/2020 5:46:46 PM FSLY $79.30 cost. STO 87C for 1.75 and BTC the 87C today for 0.80 and then turned around to STO the 80C for 2.00. Breakeven looking at $76.65.  |

| sandjco 648 posts msg #153590 - Ignore sandjco |

8/15/2020 8:47:37 AM For the purposes of this thread, this will be my final entry. Thank you to those who dropped by! When I started this in Jan 2020... Purpose: 1. Share picks so everyone here at SF can benefit. I may also benefit from someone else's idea and/or post. Something like a crowdsourced stock picking and I can track how we did over the years... 2. Anyone can post. Only thing I ask is to keep the discussion civil so as to make the thread easier to follow with less clutter. I think I have accomplished most of the above. The only part that the thread didn't accomplish was generating pics from others consistently. I knew that would be a challenge as it can lead to a vulnerable spot. What I gained from this experience: - because I had to post the play; it reduced my derp play tendencies (how am I gonna do that now lol!) - allowed me to keep track of the play more meticulously (led me to look for scripts on "stops" and/or portfolio management) vs flying on the seat of my pants when it came to my exits. I am still horrible at this. - allowed me to put my thoughts in writing and annotating the charts to post/play which allowed me to look at things differently (maybe naively?) when the market dumped and apparently the end of the world was near... - keeping trading notes. I have Xarlor to thank for this. I still am lazy and horrible in doing it; I need to be better. What lessons stayed the same and helped? https://www.stockfetcher.com/forums/Stock-Picks/A-Newbie-s-Journey/136535/470 1. While EVERYONE can see the same picture; not all of them will trade it the same way. 2. While EVERYONE can have the same filter; not all will be able to use them the same way. 3. Do not let expectations lead to belief (I was so used to taking money from the XIV ATM machine...till it blew up! Only prudent risk control prevented a massive implosion!) 4. Bears make money, Bulls make money....Pigs get slaughtered. 5. Always be learning because the market can humble you! I've printed the above and have it taped over each of my monitors to remind me every day that my behind can be handed to me any time any day. While my thesis may be ultimately right over time; it wouldn't matter if the market doesn't agree with it at time of the entry/exit. Things that I still need to work on: - reduce the number of scripts I have going on... - simplify simplify simplify - continue to read the forums and understand how to code SF What have I being doing when I am faced with a losing position? - Ask myself: was that it derp play (i.e. self inflicted zero plan trigger) or it just didn't go as planned right away (e.g. FSLY)? - IF it was a derp play, I bail with no questions asked (e.g. TSLA earnings play, stock fades after the first few 5m candles - take whatever profit you can or minimize the loss). yes, it is back up now...but it was dead money for a while. - IF I am in a slump (I define that as ending the week AND month in red). I walk away completely. I don't look at anything for a few days. Then I come back and revisit the charts that led to the derp plays. My most common derp plays: - Earnings play. A friend has called me...an earnings junkie! It is a rule that i find so hard to follow. While it has been a massive part of my wins; i fear it is only a matter of time it could go against me. One suggestion he gave me was to still play it but just play 1 contract. - Revenge play. I used to have the tendency to get fixated on trading the same stock that led to a losing hand. While some worked out; most do not. In hindsight, being emotionally invested in it clouded my mind. My biggest fear today: - surprisingly not the market or the direction or pulling the trigger now that I am more comfortable playing up or down. I have Village Elder and KSK8 to thank for the short side! I have Mac to thank for sharing Guppies and BBs on the long side! Loved the simplicity of the scripts. - the biggest fear i have today is how trading options (the leveraged results) impacts my mindset over time i.e. will the spoils of big gains led to bigger drawdowns with the wrong call? will the instant gratification ruin the patience of waiting for a position to grow? Kinda like trading XIV way back then - repeated cashing out spoiled/blinded the probability of losses; position sizing saved the risk of ruin. As of this entry, the markets have climbed the wall of COVID worry and economic uncertainty. This has led to some cash sitting on the sidelines waiting for the shoe to drop. Meanwhile, should and if the markets continue to go higher, fund companies will continue to be forced to deploy their cash as they need to keep up with the performance return stats FOMO. What 2nd wave? There are 21MM cases now with 13MM recovered worldwide. The new norm appears to be mandated masks with vaccine probably a year out. Planes are back flying sans social distancing (on some airlines). The gov't meanwhile have spent $$$ to keep us afloat. If anything, COVID has quietly challenged the "need" to work at an "office location/tower". Given how effective work from home has been for some industries; this may not bode well for commercial landlords over time in some areas. Subsidies are about to end. As always, I wish all the kind folks at SF the best and thank you for dropping by! Good luck all! My "go to" script today... |

| Mactheriverrat 3,178 posts msg #153594 - Ignore Mactheriverrat |

8/15/2020 11:41:00 AM Great thread! |

| xarlor 639 posts msg #153595 - Ignore xarlor |

8/15/2020 12:46:05 PM It's great seeing someone go through their trading journey. You have the right attitude and are open to changing what needs changing. This will make you a successful trader. I will miss your steady updates. Here are some suggestions to keep heading in the right direction. 1. Don't derp. Just don't. 2. If you're not going to update this thread, use that time to develop a trade log and keep it updated. 3. Keep learning. Though you may not use them, learn about other indicators so you know they're out there. Ichimoku Cloud, Fibonacci retracements and extensions, Pivot points, Parabolic Sar are a few. Learn more Options strategies. Learn how to combine options with stocks. Learn futures. Learn forex. 4. Don't be afraid to ask for help. I've enjoyed this thread, thank you for all your contributions! |

| StockFetcher Forums · Stock Picks and Trading · Picks and Pans Since Jan 2020 | << 1 ... 24 25 26 27 28 ... 29 >>Post Follow-up |