| StockFetcher Forums · General Discussion · Guppy Investigations | << 1 2 3 4 5 >>Post Follow-up |

| nibor100 1,102 posts msg #152705 - Ignore nibor100 |

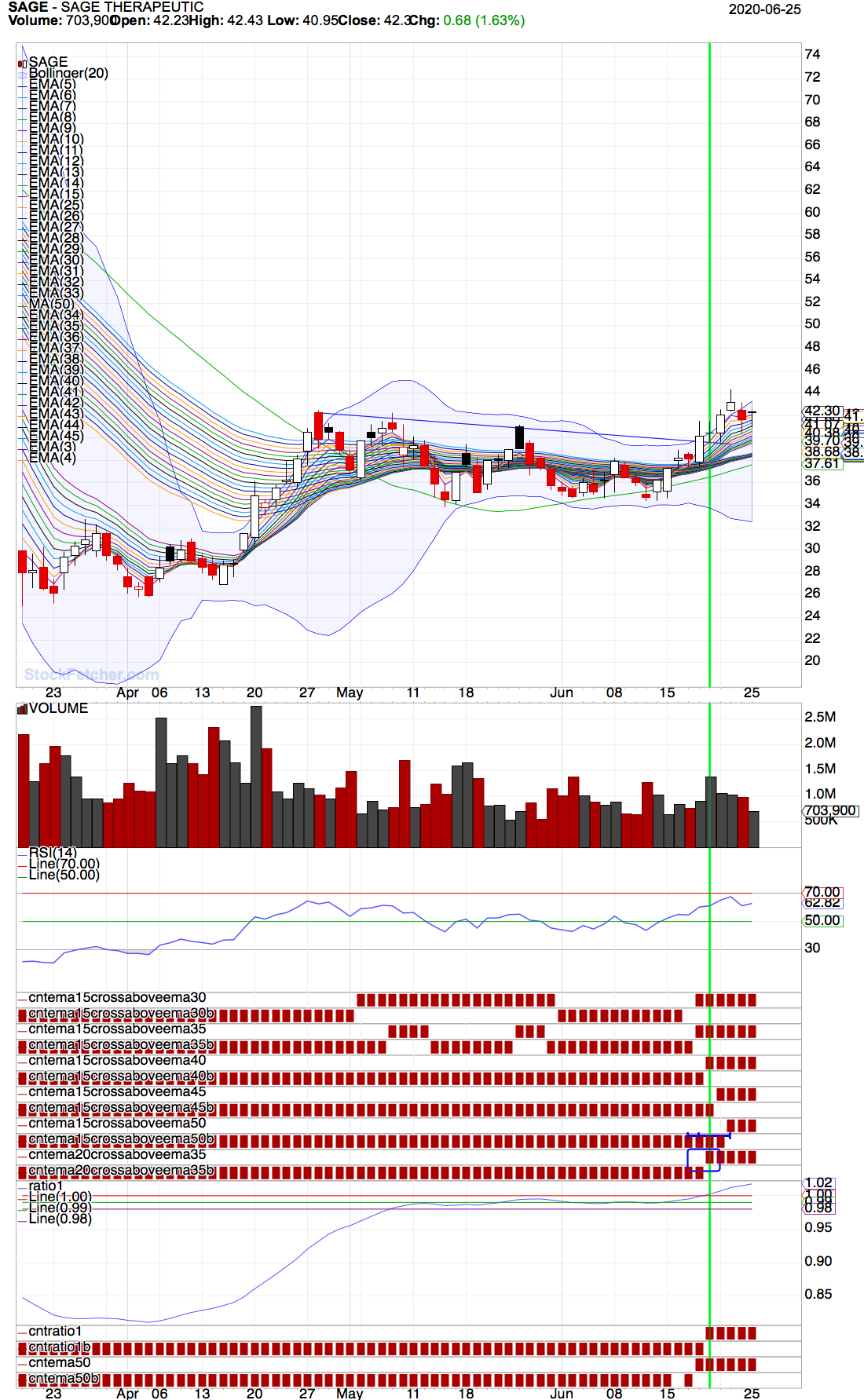

6/22/2020 4:14:10 PM Of these 2 stocks would you expect Sage to have a potentially greater move upward since its been a much longer time since its last 15/40 cross? thanks, Ed S. |

| Mactheriverrat 3,178 posts msg #152706 - Ignore Mactheriverrat |

6/22/2020 6:20:31 PM Both SAGE and ARWR both have good potential as runner's. I use the 15/40 rollover just as the first flag (or column search ) of a change in the longer term investors group. Both could run or both could peter out. The next day after the 15 / 40 cross the 20/35 usually happens along with say the 15/45 cross and the 15/50 cross. Telling me the Investors group is starting to rollover. Submit |

| Mactheriverrat 3,178 posts msg #152707 - Ignore Mactheriverrat modified |

6/22/2020 6:22:07 PM The video I posted on page 4 give's a really explanation of the Guppy MMA's. I like what Daryl Guppy says around 4:28 to 4:48 about big money. One can download that video with windows youtube downloader or a mac youtube downloader depending on the type of computer one has. That what I did with my mac and re-watch from my hard drive. |

| Cheese 1,374 posts msg #152709 - Ignore Cheese |

6/22/2020 6:46:19 PM Mac, Many Windows youtube downloaders are infected with viruses/malware or come from websites infected with viruses/malware. Do you have more information about which particular website and which particular downloader software you've actually used and found them to be safe? I use Windows 10 Thanks in advance.. |

| Mactheriverrat 3,178 posts msg #152711 - Ignore Mactheriverrat modified |

6/22/2020 7:21:40 PM Sad that there are so many virus for windows. I use Mac youtube downloader version. One might look into this link.

Also one can use Apple's Quick time and their screen recording feature. Search Google of - quicktime screen recording windows The Quick time way be the safest way to go as far as I know more Mac than Windows. |

| Mactheriverrat 3,178 posts msg #152712 - Ignore Mactheriverrat |

6/22/2020 7:30:10 PM BTW- Both SAGE and ARWR are up after-hours. |

| Cheese 1,374 posts msg #152713 - Ignore Cheese |

6/22/2020 7:38:08 PM Mac, Thanks for the info. |

| Mactheriverrat 3,178 posts msg #152714 - Ignore Mactheriverrat |

6/22/2020 7:42:11 PM The Quick time way be the safest way to go as far as I know more Mac than Windows. |

| Mactheriverrat 3,178 posts msg #152781 - Ignore Mactheriverrat |

6/25/2020 9:34:11 PM  |

| svtsnakebitn 150 posts msg #152783 - Ignore svtsnakebitn |

6/25/2020 10:19:07 PM Hey Mac - I have really been studying up on GMMA. I entered at the close today:  |

| StockFetcher Forums · General Discussion · Guppy Investigations | << 1 2 3 4 5 >>Post Follow-up |