| StockFetcher Forums · Stock Picks and Trading · Picks and Pans Since Jan 2020 | << 1 ... 10 11 12 13 14 ... 29 >>Post Follow-up |

| sandjco 648 posts msg #151782 - Ignore sandjco modified |

4/8/2020 11:04:13 PM 1,500,000 cases worldwide; 435,000 at home. The mud slinging has been non stop. Trump says WHO? WHO says no politics! Wuhan re-opens after 80 days? So far the market has bounced....pump and dump? who knows... IWM calls have more than doubled.   Crazy but great week or so. Most difficult part was buying when things were in the "red". A stupid mistake or maybe not...forgot I got orders on QQQ Jun 250C on low ball bids that got filled. Either an expense mistake or...  edit: https://www.stockfetcher.com/forums/Stock-Picks/A-Newbie-s-Journey/136535/30 four/pthomas215/eman93..if you guys are still around...thank you. Your early posts to me helped out.... four 5,087 posts msg #136543 - Remove message 6/27/2017 10:53:44 PM My plan was to "build" the position -- What happens to your model when we flip it. Same rules... but buy on a percent move up, not down. Do you wish to buy more of a stock that is going up OR more of a stock that is going down? Another view point: There is a famous picture of Paul Tudor Jones relaxing in his office with his feet kicked up. A single sheet of loose-leaf paper is tacked on the wall behind him with the simple phrase written out in black marker: �Losers Average Losers�. Famed trader Jesse Livermore warned 100 years ago against averaging losses. Losers Average Losers: Paul Tudor Jones - Trend Following https://www.trendfollowing.com/losers_average_losers/ Also, my original strategy relying mainly on RSI2 and the LRS would have lead me to implode as I probably wouldn't have been nimble enough to deal with the whipsaws   Investor Group turning after watching the Trader group having fun?  |

| sandjco 648 posts msg #151795 - Ignore sandjco |

4/10/2020 1:48:07 PM Coding help required please... As shared by shil... shillllihs msg #151786 4/9/2020 10:40:30 AM The way I determine a bear market is if monthly ma2 is over ma21 on SH, IF April doesn't close above we are in a bull market again. Amazing. So I did.. Question: How do I then use the "bull" or "bear" answer from the above to then code... IF Bull, then buy whatever is in my watchlist if RSI(2) < 20 IF Bear, then sell whatever is in my watchlist if RSI(2) > 80 Thanks in advance; appreciate the help as always. |

| shillllihs 6,102 posts msg #151798 - Ignore shillllihs modified |

4/11/2020 2:33:04 AM Sure, thanx. Works better as a monthly long term guide. Here's something I've been experimenting with though it's not perfect. Go long or short above or below middle 2 lines, your exit is up to you. |

| sandjco 648 posts msg #151807 - Ignore sandjco modified |

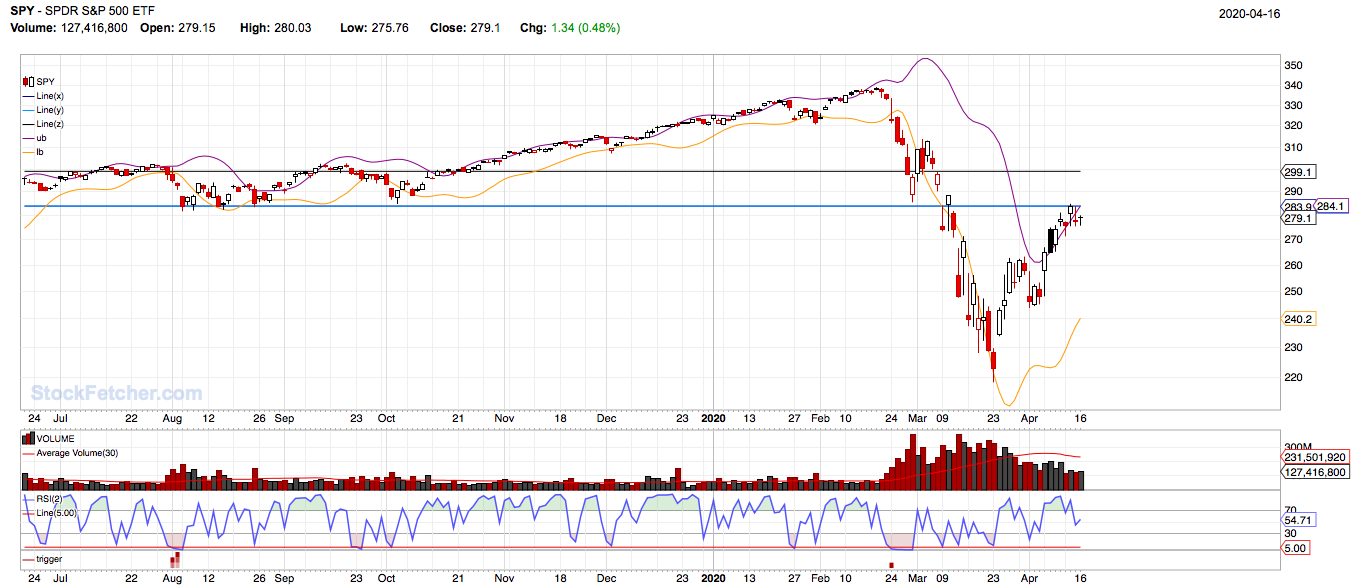

4/12/2020 12:02:37 PM Thanks shils! Using the experimental shil bands... SPY busted out on the 6th, so did the QQQs and DIAs   Not surprisingly, SH...   Amazing resilience really watching the rebound and comparing it to the bleak headlines that have dominated the airwaves for the past month. - 1.8MM cases with 111K mortality. US has the highest cases and death rate at 500K/21K with NY at 180K cases - Trump escalates battle with WHO and as if on cue...lauches political ad for the upcoming election painting Biden as week and China friendly - August will apparently be lower than March low (https://www.marketwatch.com/story/stocks-will-revisit-their-coronavirus-crash-low-and-heres-when-to-expect-it-2020-04-09?siteid=yhoof2&yptr=yahoo) Ah ..what to do? I have no crystal ball...all i can do is trade the trend. Right now, it is up. Feels like playing musical chairs or sneaking up a booty call with the ex while her hubby is next room snoring! Guess the prudent approach would be to book the gains - profit is profit mantra instead of being greedy? Hate the weekends as you never know how Monday will pan out! |

| sandjco 648 posts msg #151826 - Ignore sandjco |

4/14/2020 9:11:42 AM Hmmm who woke up from the slumber party...while the world is apparently gonna go belly up!  Will this be the next one....  |

| sandjco 648 posts msg #151834 - Ignore sandjco |

4/15/2020 9:07:51 AM  no one wanted to be left behind? Setting for??  |

| sandjco 648 posts msg #151838 - Ignore sandjco modified |

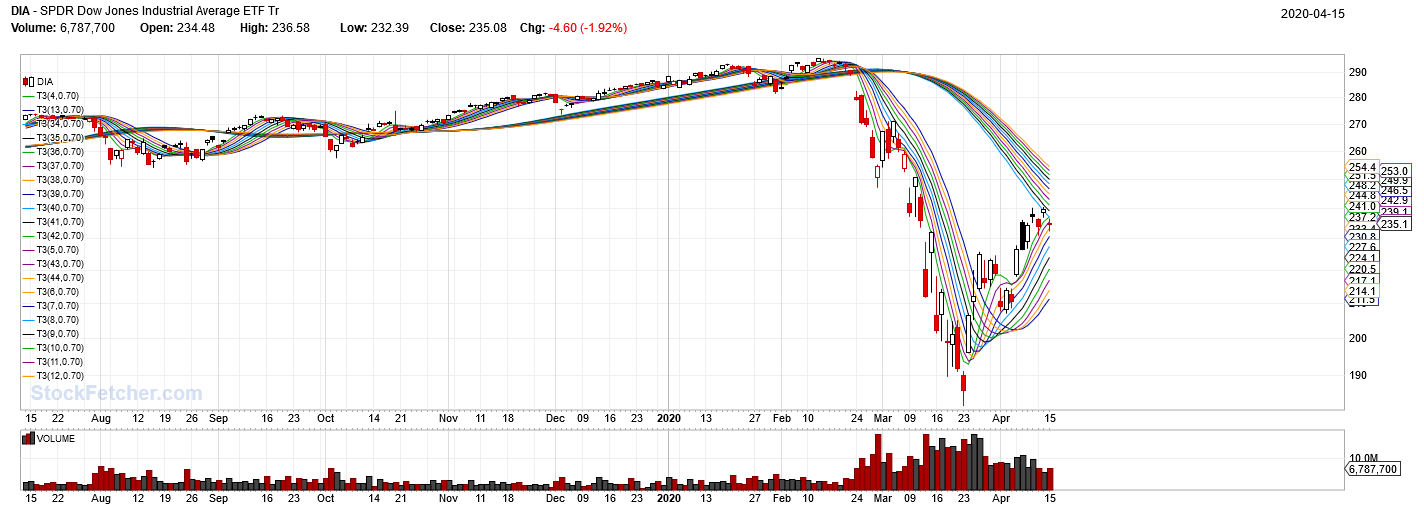

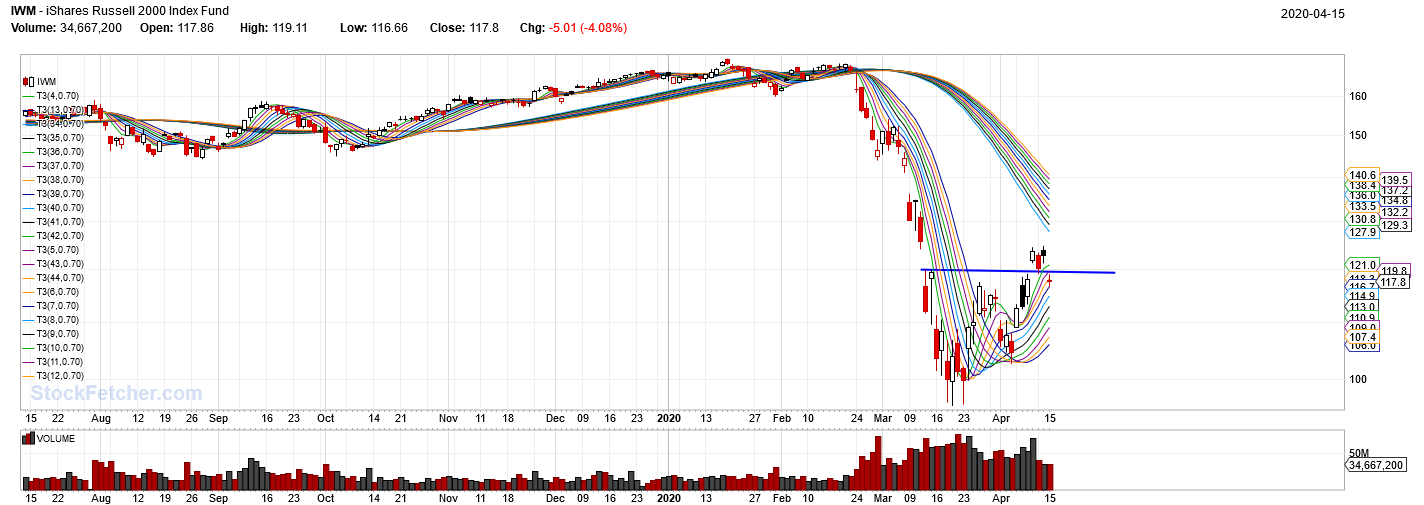

4/15/2020 11:46:51 PM Musical chairs still going and going?? Fork on the road coming up?     Bounces off...    Guppy view   |

| Nobody 404 posts msg #151841 - Ignore Nobody |

4/16/2020 11:55:51 AM Look like the first / half part of letter 'W' I don't know |

| sandjco 648 posts msg #151843 - Ignore sandjco |

4/16/2020 9:28:19 PM @nobody....hence the fun part! maybe it will hit prior resistance then drop to a lower bottom...  |

| sandjco 648 posts msg #151857 - Ignore sandjco |

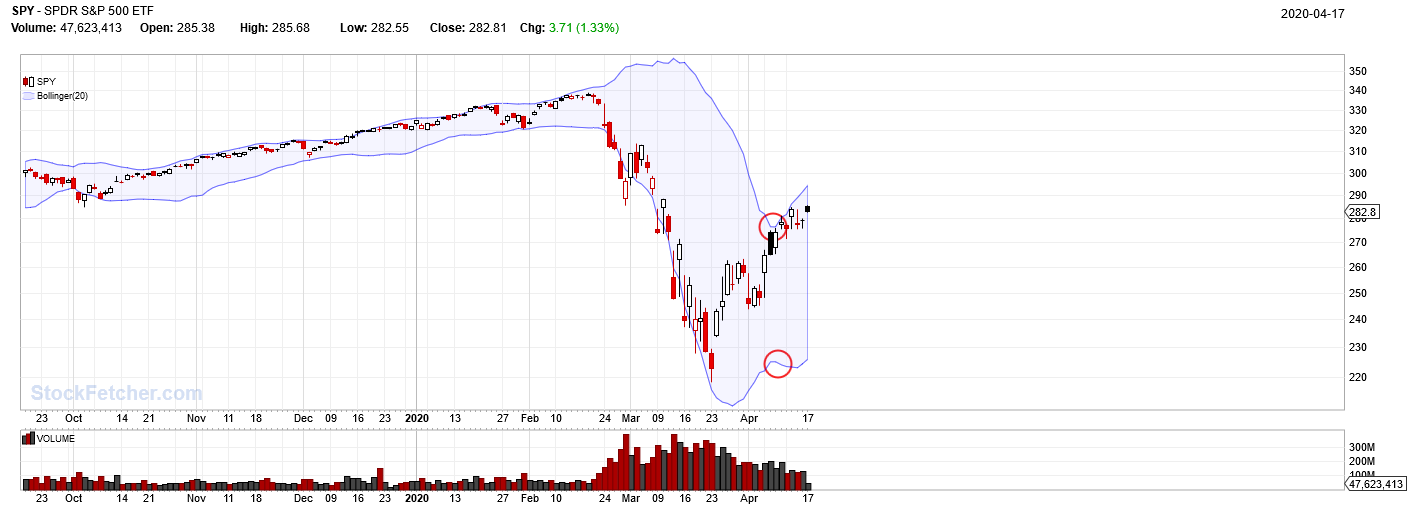

4/17/2020 11:13:35 AM "futures up 3%" before market opened today (Friday) due to apparently GILD ($83) making headway on a vaccine. ANALysts however, are unimpressed as there apparently isn't a "controlled" group. Meanwhile...2MM cases world wide with 4% critical (56K); we are now at 680K So far, SPY opens with a whimper...however, new economy (Q's) seem to like it better      coding from Xarlor; shill's idea. https://www.stockfetcher.com/forums/Filter-Exchange/Maybe/151809 |

| StockFetcher Forums · Stock Picks and Trading · Picks and Pans Since Jan 2020 | << 1 ... 10 11 12 13 14 ... 29 >>Post Follow-up |