| StockFetcher Forums · Stock Picks and Trading · A Newbie's Journey | << 1 ... 37 38 39 40 41 ... 48 >>Post Follow-up |

| sandjco 648 posts msg #147659 - Ignore sandjco |

5/2/2019 11:57:49 AM Closed all positions. Dipped into QQQ Jun 176P $1.25 |

| sandjco 648 posts msg #147676 - Ignore sandjco |

5/3/2019 12:29:58 PM Too early to the sell in May go away party(if there is one)! Useless to sell the Puts; may just let it expire worthless. Reminding myself...trend is your friend.... |

| sandjco 648 posts msg #147707 - Ignore sandjco |

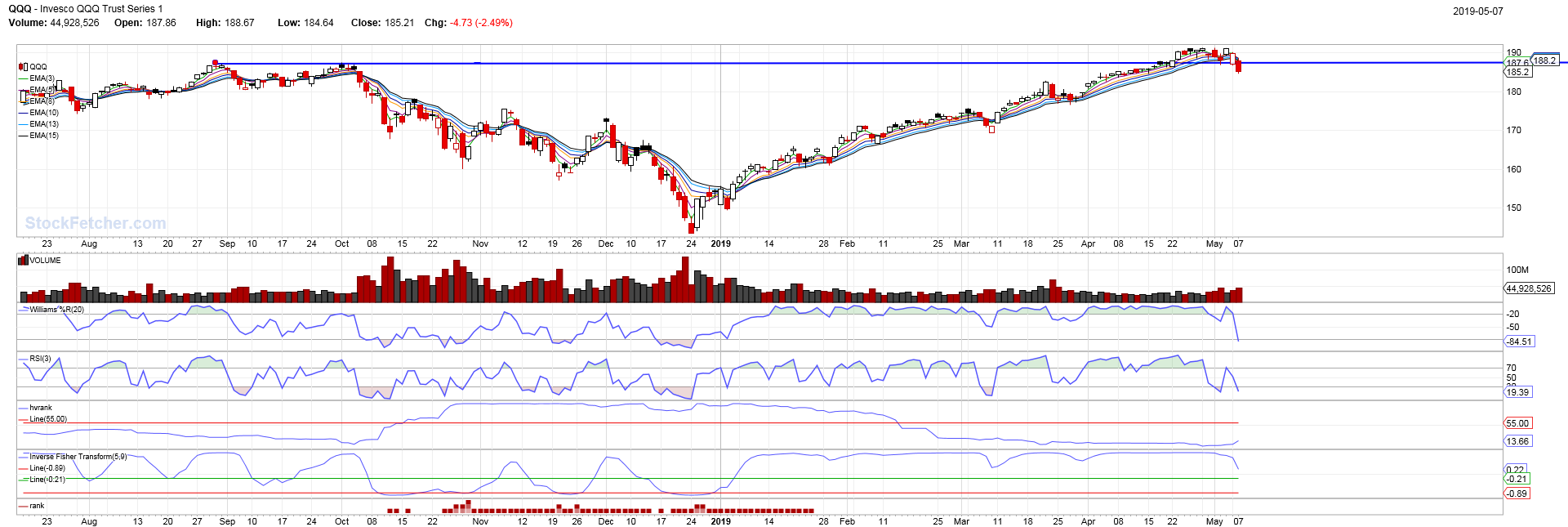

5/7/2019 4:04:29 PM Got stop out 75% of position at $2.05 for 64%  The market seems to be rolling over (with Trumps' help). Signs of more to come? |

| Cheese 1,374 posts msg #147709 - Ignore Cheese |

5/7/2019 5:25:11 PM Congrats, sandjco ! It seems like the shorter-term trend is your friend, and you did follow it to profits, I don't know options at all, so I'm guessing that "hvrank" is about historical volatility ? and "rank" is some sort of a count? |

| sandjco 648 posts msg #147712 - Ignore sandjco modified |

5/8/2019 12:04:33 AM Thanks Cheese! I think the blind squirrel found a nut there! Still trying to figure who is my friend... Yes, HV is the volatility (haven't really completely figured out is effective usage) set{HVHi, Historical Volatility(34,1) 233 day high} set{HVLo, Historical Volatility(34,1) 233 day low} set{HVrange, HVHi - HVLo} set{HVdiff, Historical Volatility(34,1) - HVLo} set{HVRank1, HVdiff / HVrange} set{HVRank, HVRank1 * 100} add column HVRank draw HVRank line at 55 and yes, rank is just my trying to count the dips...which as you can see there isn't a strong correlation so it is a work in progress. Thank you (and the other "regulars" by the way for all your ideas that you guys share. I've been here for more than a year and it is amazing that I still have so much to learn (and still a crappy coder!). |

| Cheese 1,374 posts msg #147716 - Ignore Cheese modified |

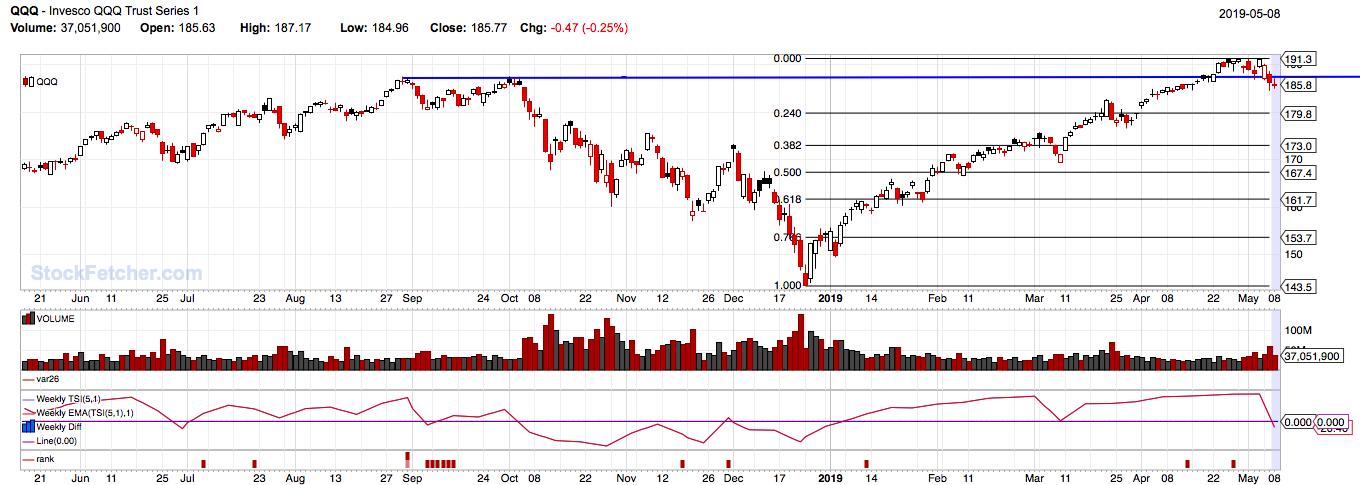

5/8/2019 9:54:31 AM sandjco, thanks for the explanations. You may want to take a look at this Guppy Oscillator by chetron https://www.stockfetcher.com/forums/Filter-Exchange/MMA-Indicator/34384/10 Happy trading. |

| Cheese 1,374 posts msg #147718 - Ignore Cheese |

5/8/2019 10:21:33 AM sandjco, signals from this version of chetron's guppy oscillator may be more aligned with shorter-term decision support. Happy trading. |

| sandjco 648 posts msg #147722 - Ignore sandjco |

5/8/2019 12:50:53 PM Thanks Cheese! Here is my iteration; as im visually challenged (jk), I am constantly trying to find ways to make the info I have shown in simple terms to reduce the stress on my limbic brain! Still trying to simplify to find what works and what does not work for my own style and reduce "gut" type decision making when entering or exiting trades. I exited the last of my QQQ puts arbirarily instead of letting a signal (maybe EMA cross) based on "feel". The same "feel" told me to go long in Dec but waited for the indicators to support and missed good entry points. But I am doing my best to think that it was a bet (my choice) that I preferred not to take and the next bet(s) should be independent of the previous bet. From the book "Thinking in Bets" (I think shared by four). I've been trying to sort which indicators (kinda like trying to date multiple babes) that works for ME (guess that is where the "art" of trading comes in - same indicator but seen different ways by different traders) and then simplifying the progressions I go thru in taking a trade. Ultimately, I would love to be able to just use price and volume action to enter/exit. Again, thank you and eveyone who has been so kind to help me with my journey. |

| Cheese 1,374 posts msg #147724 - Ignore Cheese |

5/8/2019 1:40:25 PM Thanks, sandjco. Nice filter. I am not new to sF but I am still a newbie at trading so your thread resonates with me. I've got good info like the 2/3/5 progression from your thread, and I can relate to the challenge of finding profitable trends. Good trading to you and everyone. |

| sandjco 648 posts msg #147743 - Ignore sandjco |

5/9/2019 8:40:44 AM where to next?    or is it letting expectations lead to belief? |

| StockFetcher Forums · Stock Picks and Trading · A Newbie's Journey | << 1 ... 37 38 39 40 41 ... 48 >>Post Follow-up |