| StockFetcher Forums · Stock Picks and Trading · Using Guppy GMMA - Put AMBA on pullback watch list buy in today. | << 1 2 3 >>Post Follow-up |

| Mactheriverrat 3,178 posts msg #130784 - Ignore Mactheriverrat modified |

9/1/2016 1:42:25 PM Submit Looking at past chart for the last year and a half one can see the trend and when its long by the longer term group of averages. I will wait over the weekend to see how this market play out with this SPY squeeze thing. If SPY breaks lower on socalled bad news then trends will be shaky until the dust settles- |

| graftonian 1,089 posts msg #130845 - Ignore graftonian |

9/3/2016 7:46:08 PM |

| Mactheriverrat 3,178 posts msg #130846 - Ignore Mactheriverrat modified |

9/3/2016 7:48:56 PM my StockFetcher filter exceeds filter performance restrictions. For basic price mine works fine. There are some other thing SF could like when one brings a say pop up 1 year chart . Make it where I could pick another color for drawing a trend line say in red but have it where I could use the same red each time. The color picker isn't the best i've seen. |

| graftonian 1,089 posts msg #130853 - Ignore graftonian |

9/4/2016 10:27:34 AM Mac, I agree it would be nice if one could choose the color of lines drawn. Scottrade elite has this feature, and the charts are much more readable. Also, one can choose different colors for up and down trends |

| graftonian 1,089 posts msg #131132 - Ignore graftonian |

9/13/2016 10:23:13 AM Mac, Using this GMMA technique, when do you feel SPXU will be a buy? Or is it there allready? |

| graftonian 1,089 posts msg #131188 - Ignore graftonian |

9/15/2016 6:09:03 PM Mac, What kind of filter do you use to find a list of candidates of GMMA? |

| Mactheriverrat 3,178 posts msg #131245 - Ignore Mactheriverrat modified |

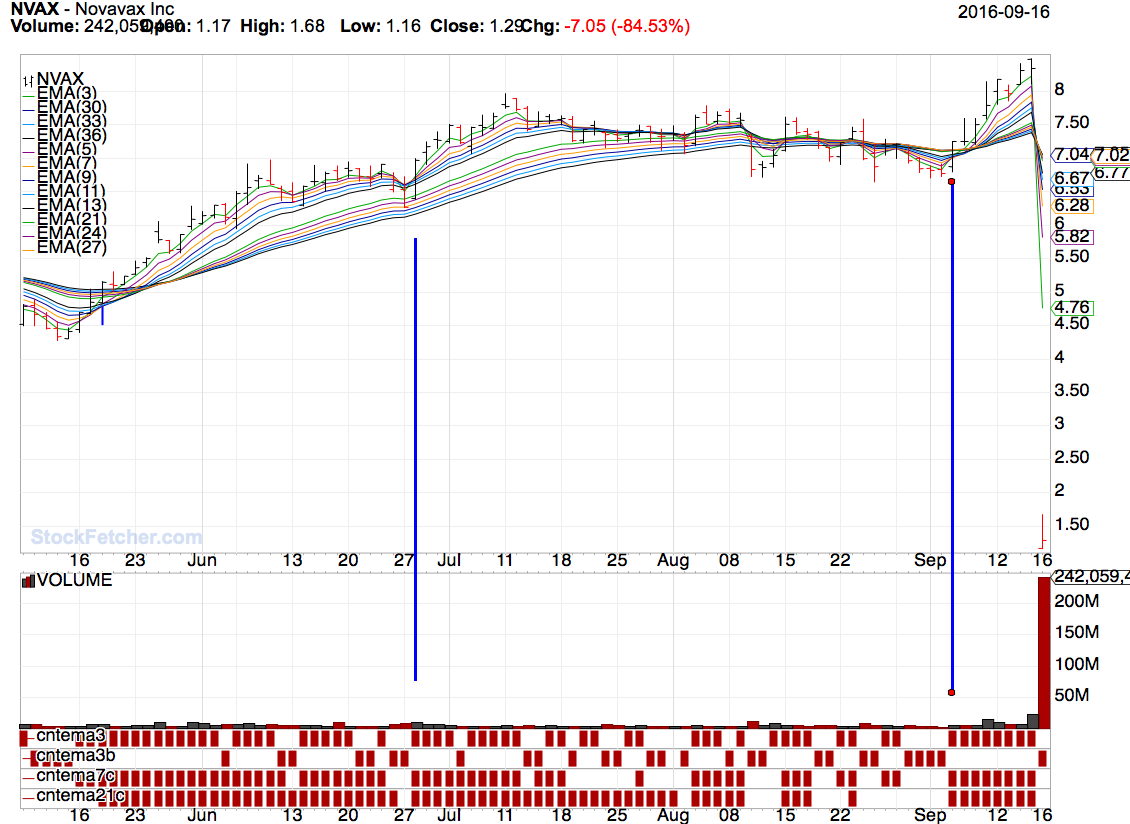

9/17/2016 11:48:40 PM Submit Not a bad video. It shows basic Guppy idea . Watch how the EMA(3) and EMA(5) has its first day up in a strong trend. The person who made missed a few shot's but it give's the user at least a idea.  Colored Box's are below - 1st- EMA(3) above EMA(3) one day ago 2nd -EMA(3) below EMA(3) one day ago 3rd -EMA(7) above EMA(7) one day ago 4th - EMA(21) above EMA(21) one day ago 5th - DxD is where one can sort by EMA(3) for day 1 6th - ExE is a look at the EMA(21) The longer term investor's are the Alan Hull version not the true guppy 30 to 60 EMA's. One can add his or her own indicator's . I think the less the better. IMHO. One can change the Volume to more and the Average Day Range(30) to less to narrow down stocks, |

| Mactheriverrat 3,178 posts msg #131247 - Ignore Mactheriverrat |

9/18/2016 1:14:20 AM @ Graf All stocks like SPXU,TVIX, UVXY and other's wouldn't use longer term average's As you can see SPXU longer average's are just to a squeeze and not rolling over not saying that they won't. Look what SPXU has acted in the past. |

| Mactheriverrat 3,178 posts msg #131249 - Ignore Mactheriverrat |

9/18/2016 2:37:28 AM Let watch CHK and see what happen's.  |

| pthomas215 1,251 posts msg #131256 - Ignore pthomas215 |

9/18/2016 11:38:12 AM Mac, this is great stuff. I noticed when the ST MA crosses above the LT MA you see the spike. The greatest thing about the guppy it is usually a run afterwards so you can swing trade it. what averages (i.e. ema(3) ema(5) ) do you think are more important when it comes to crossover? Or do you think it is more important to look at spacing between ST and LT? |

| StockFetcher Forums · Stock Picks and Trading · Using Guppy GMMA - Put AMBA on pullback watch list buy in today. | << 1 2 3 >>Post Follow-up |