| StockFetcher Forums · Stock Picks and Trading · Picks and Pans Since Jan 2020 | << 1 ... 7 8 9 10 11 ... 29 >>Post Follow-up |

| sandjco 648 posts msg #151161 - Ignore sandjco |

3/10/2020 8:56:37 PM NVDA didn't break prior low. No action today. Missed the upside action after yesterday's carnage. The bias of expecting it to go down....prevented me from seeing the opportunity to take the opposite action. |

| sandjco 648 posts msg #151166 - Ignore sandjco |

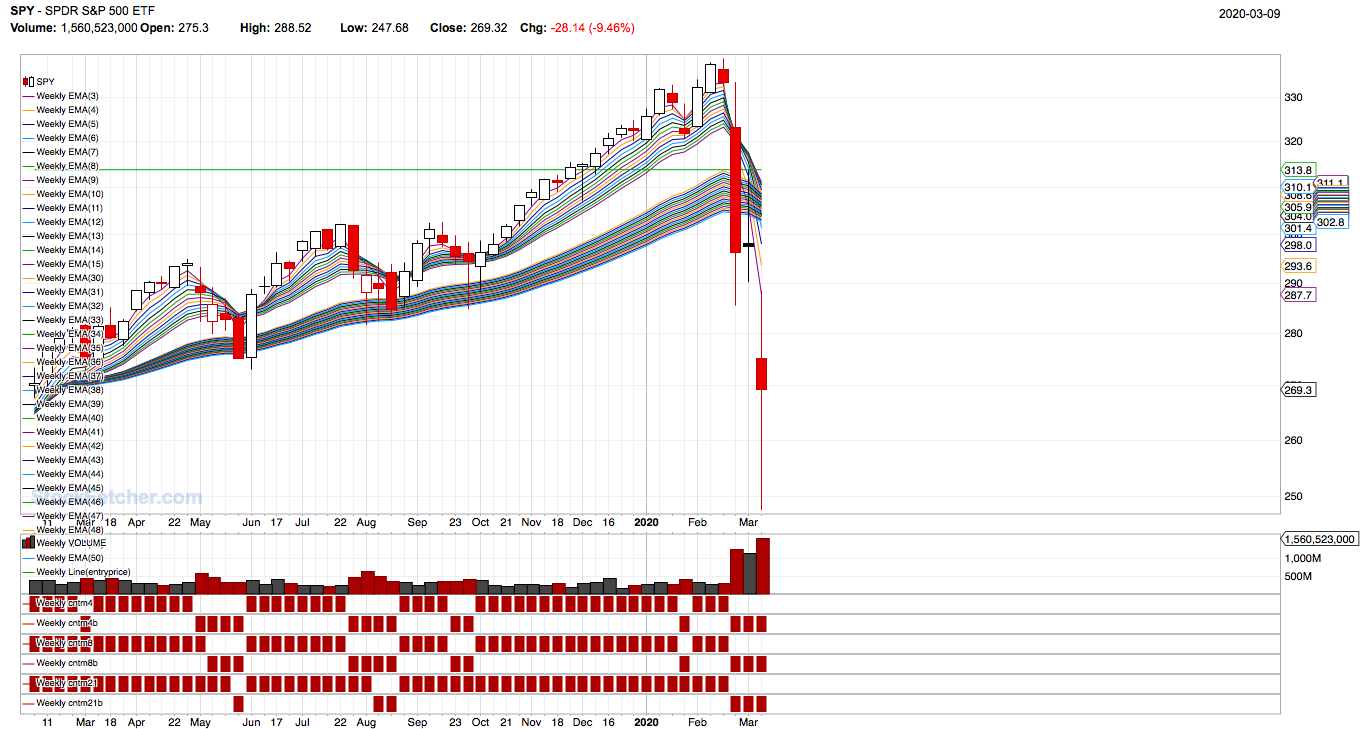

3/11/2020 8:06:58 AM Will be interesting to see how the price action impacts these bands... T3  Guppy  One would expect some sort of consolidation after the carnage....?? Have to remind myself...fortune tellers don't become trillionaires! From a fundamental perspective....earnings for most companies will be impacted for sure given the travel bans, stay at home orders, supply chain disruptions. This will probably take 2 quarters to sort out assuming cases stabilizes by April. Till then, I nibble away at great companies for the BH portfolio. https://www.worldometers.info/coronavirus/ |

| sandjco 648 posts msg #151189 - Ignore sandjco modified |

3/12/2020 7:05:27 PM Selling begets selling... NFLX, AAPL and NVDA worked out...       Even..   Waiting for the cover pages of TIME, FORBES, etc.... |

| sandjco 648 posts msg #151190 - Ignore sandjco modified |

3/12/2020 9:46:32 PM Hindsight is 20/20... I need to stick with the plan (broken record) and have the conviction to see it thru... MSFT Mar $157.50P bought for $1.80; $14.16 today and here I was happy with my double... AAPL Mar $300P bought for $10.55 now at $46 TLT May $146C bought for $11.40 now at $27 SPY May $335P bought for $9.60 now at $81 Bruh! Too focused on trying to compound the small wins and risk containment...missing the balls to go big! Such a big part of success is MINDSET....I need to figure it out. The carnage continues... EDIT: NBA/NHL cancels ....DIS closes... |

| sandjco 648 posts msg #151196 - Ignore sandjco |

3/13/2020 8:05:43 AM GBTC  Bitcoin didn't fare any better during the carnage... At home, 135 new cases reported. 5.5 cases/1Mpop Will be looking to short CMG, ALGT, UBER and DIS |

| sandjco 648 posts msg #151221 - Ignore sandjco |

3/14/2020 9:49:34 AM No trades; market when up big after Trump speech (wow)   Weekly Guppies...with an interesting Candle as if to say i don't know where to go next...  US now up 7.1/1M pop from 5.5/1M pop Travel restriction ban in effect to the US unless coming from UK and Ireland Canada slashed its prime twice in a week OJ Simpson hoarding toilet paper from Costco Schools are closed Getting emails now from FIs to stick with the plan and remind me that these are buying opportunities. Begs the question...where were they before the crash telling me to raise cash? What if I didn't discover SF and didn't raise any dry powder to play? Guess in the AUM business, you would have to give them more...brilliant business actually. Gotta give credit where credit is due. Thank you to Mac...for sharing Guppies! For someone visual like me...it kinda makes sense (kinda cause i still don't know anything...) and it kept me grounded. 2/21 first warning...2/24 2nd warning. Played it right on 2/21...just didn't think (analysis paralysis) that it would turn out this bad as RSI was already heading towards lows (wrong read as it can go and stay lower). https://www.stockfetcher.com/forums/Stock-Picks/Picks-and-Pans-Since-Jan-2020/150081/50 Onto the next plays...patiently (new territory for my mind). |

| sandjco 648 posts msg #151242 - Ignore sandjco modified |

3/15/2020 9:20:22 PM FED slashes rates to 0; QE restarts. The rallies have been sold as expected. 1st wave of selling hit; those clients that the brokers managed to have stay put will now be jittery and want to sell. Selling begets selling? NVDA WYNN QQQ SPY ALGT ETSY WMT SHOP No capitulation yet...don't feel like it. EDIT: US now at 11.3/1M pop https://www.worldometers.info/coronavirus/#countries |

| sandjco 648 posts msg #151249 - Ignore sandjco |

3/16/2020 2:20:00 PM Note to self...the premiums (as if I understand that) on any put plays seems to be so stupidly marked up that it doesn't make sense anymore unless there was a huge move associated to it. Shorting NVDA and WYNN outright was an easier fill than bidding on the puts.  This is getting ugly. So many broken charts. SPY to break or hold 235?  |

| sandjco 648 posts msg #151255 - Ignore sandjco |

3/17/2020 12:37:57 AM Will not post my short plays in the context of what's happening. Feels kinda weird. Will continue to post like a diary to follow how all the market evolves thru this pandemic. All shorts closed EOD; NVDA was huge as the day ended. I only have SPXS with a stop of $16 right now; will adjust accordingly. |

| sandjco 648 posts msg #151266 - Ignore sandjco |

3/18/2020 12:53:30 AM What I've "uncovered"...I'd like to call them "rules" but I know I will most likely break a few here and there and then go back to "self therapy" to try not to do it again! 1. You are only as good as the last trade. Not complicated. Check your ego at the door. 2. Stocks don't have feelings; go long or short. 3. Do not trade during the first 15 minutes. 4. No revenge trade. Babe burned you; no need to chase. There are other babes. 5. Adding to a losing trade is most likely a crap shot. Set your limit; let it go. Hard to fix ugly. 6. Technique/Plan is useless if the mind is weak 7. You don't have to label yourself...swing or scalp or ? All you need to know is that you are not buying and holding if you are trading off charts 8. Profit is profit. So what if you may have missed the big run...knowing you called it correctly builds habit and the ability to spot the next one. 9. shooting consistency all the time is better than going for the home run all the time. 10. Market can be illogical. Being "right" can be expensive as time may not be on your side to fix the wrong entry |

| StockFetcher Forums · Stock Picks and Trading · Picks and Pans Since Jan 2020 | << 1 ... 7 8 9 10 11 ... 29 >>Post Follow-up |