| StockFetcher Forums · Stock Picks and Trading · Picks and Pans Since Jan 2020 | << 1 ... 4 5 6 7 8 ... 29 >>Post Follow-up |

| sandjco 648 posts msg #150813 - Ignore sandjco |

2/18/2020 1:29:05 PM SPCE short using Feb 28th 25P for $1.65  As per Village Elders' short system. Could not short at "open"; using puts to play. |

| sandjco 648 posts msg #150816 - Ignore sandjco |

2/18/2020 4:04:56 PM Thank you Village Elder! sold 3/4 of the position at $2.40 for 50% before commissions. I'd say t'was a good day today! Picked up TGT Mar 120C for $3.40...will the Guppies hold or will the Corona virus hit? WMT earnings today? uh oh...didn't think about that....but analysis paralysis so...  PAYC has ramped up; sold 3/4 of the position for 60%+.  Picked up NVDA Jun 340 to see if there is a follow thru...so far, so good...  Picked up VEEV Mar 160 to see if there will be a follow thru..so far, so good...  Did not add to ROKU. Will wait this bad boy out...  Interestingly AAPL warned it would not meet...and it barely moved...wanted to go short but...hmmm.  |

| sandjco 648 posts msg #150827 - Ignore sandjco |

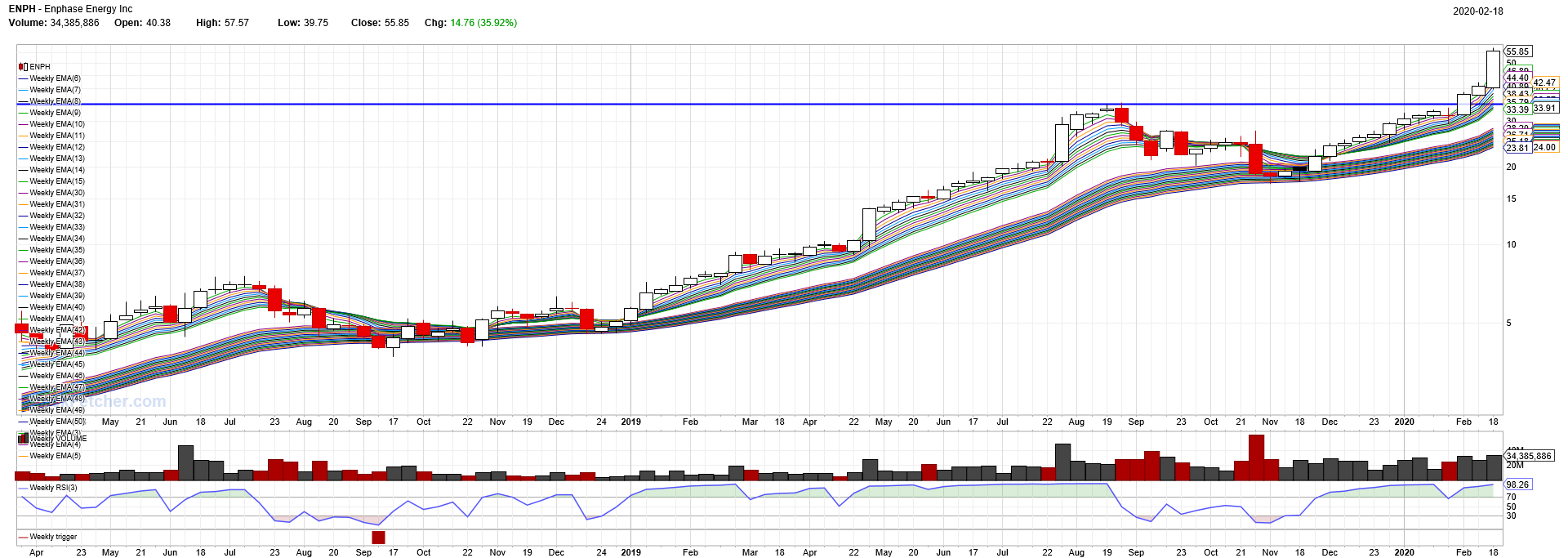

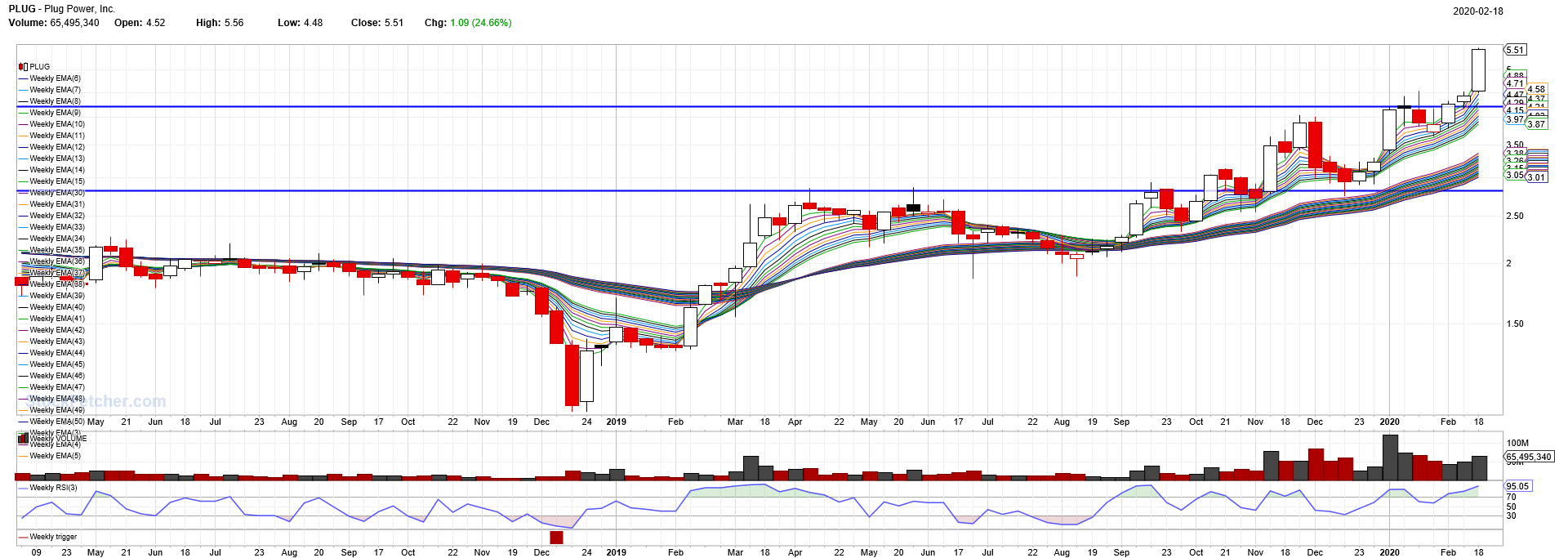

2/19/2020 2:25:23 PM Urghhh….to ride the gravy train longer or to get off..... Picked up ENPH Mar 55C for $4  Released earnings and guided up. Im guessing IV on this puppy must be high...let's see what happens. Picked up PLUG Jan 5.50C for $1.30 no news...  Will probably selloff 3/4 of positions on NVDA and VEEV EOD. Will close out PAYC for over 100% |

| sandjco 648 posts msg #150832 - Ignore sandjco |

2/20/2020 11:27:31 AM All cash except for ENPH calls. |

| sandjco 648 posts msg #150852 - Ignore sandjco modified |

2/21/2020 11:10:22 PM May 335P SPY using $9.60 EOD price  My ROKU C will be held till expiry or will close worthless. Chalk it up to impatience and trading on earnings, Just thankful NVDA, PAYC, TNDM, SPCE et al more than covered for the cray cray bonehead play. |

| xarlor 639 posts msg #150857 - Ignore xarlor |

2/22/2020 12:10:03 PMMy ROKU C will be held till expiry or will close worthless. Chalk it up to impatience and trading on earnings sandjco, don't take a max loss! One of the biggest advantage of using options is how many options (pun definitely intended) we have to mitigate losers. Will your ROKU call become profitable? Doubtful; 7.49% chance it ends up ITM. But you can reduce the loss you take. Below are some ideas to consider. I have put in bold how much your max loss can be reduced to in each case. Please be aware that some strategies INCREASE your max risk. I have noted those that do. Prices are of course during market close, so they won't exactly reflect what you can get come Monday. Disclaimer: Options can involve greater risk than is generally associated with stocks. Options can result in significant capital losses and may have a detrimental effect on the value of your portfolio. If you don't understand options, you WILL LOSE A SHIT TON OF MONEY. My advice is not a recommendation to purchase or sell any given security. If you don't get it, you will lose money. Don't do it. Stay bullish:Turn it into a Call Debit Spread. SELL -1 ROKU 100 17 APR 20 165 CALL @1.41 LMT You guarantee a max possible outcome of -$244, but your max loss is reduced to -$744 instead of the -$885 you paid. Create a butterfly. SELL -2 ROKU 100 17 APR 20 155 CALL @2.26 LMT BUY +1 ROKU 100 17 APR 20 150 CALL @2.90 LMT Max possible outcome: -$215. Max loss: -$715 Sell earlier dated calls for a rolling Call Calendar. Choose the $160 strike of any earlier date and sell it. For example, sell the 06MAR2020 for -$15. When it expires worthless, do the same for 20MAR2020 and keep doing it till the week before your expiration. Alternatively, just sell the week before right now for -$116 and let it ride to expiration. Once expired, do the Call Debit Spread above. Max loss here is variable as it's a tiered approach. However, this leaves you open to the 7% chance of ROKU coming back to $160 before April, although Theta will have killed you by then. Flip to bearish:Create a Call Credit Spread (possible increased risk). SELL -1 ROKU 100 17 APR 20 155 CALL @2.26 LMT Increases your max loss to -$1159, but only if ROKU rises to $160 by expiration. If it stays below $155, then your max loss is reduced to -$659 Go NeutralIn addition to the Call Credit Spread above, sell a Put Credit Spread to turn it all into an Iron Condor SELL -1 VERTICAL ROKU 100 17 APR 20 85/80 PUT @.41 LMT Reduce your loss by an extra -$41 by selling a Put credit spread. Max loss is -$1118, but as long as ROKU stays between $86 and $155, your max loss is reduced to -$618. |

| sandjco 648 posts msg #150863 - Ignore sandjco |

2/22/2020 5:39:04 PM Hi Xarlor! First off, I do sincerely hope that you have benefited from the plays I posted since I started this thread for you are one of the most consistent kind poster who have absolutely helped me along my journey. You give even when there is nothing there for you. I do hope you do stick around for a long time as I have seen a few good ones disappear! Thank you so much for putting in the time and effort to provide me with the possible plays I can do to salvage this position. With Options, I only do outright C or P as I am hopelessly lost on the Geeks! There is another choice - sell for a loss (obviously a pain which should teach me a lesson!) asap and use whatever I can get out of it as ammunition for the next play. Hindsight is 20/20...with ROKU - I played earnings (even stated that I broke my rules! funny but not funny). - got spoiled on my historical easy gains riding a hot stock and thought that babe would make me happy eternally! - Did not bail (when i usually do if it does follow thru) thinking how can the market not appreciate the beat? Doesn't matter if i am proven right...the market is ruthless (I should know that). Ironically...I should be drunk with joy with all the winning plays...but ROKU really left a bitter taste. Gut said to avoid the play and yet I went! My "earnings" adventure. AAPL, TSLA, ENPH, AMZN (not posted) and NVDA all rocked it. Got spoiled...and "lucky"? GOOG and FB were blah and ROKU was a bloodbath. Given the high IV around earnings...my limited option logic would suggest...playing options near earnings dates are not very ahem smart (please correct me if my observation is wrong). Have a wonderful weekend Xarlor, and again....I am very appreciative of the time and effort you took to post on my thread! |

| xarlor 639 posts msg #150865 - Ignore xarlor |

2/22/2020 6:08:12 PM Hey, no problem sandjco! I pipe in when I know my knowledge can make a difference. I just hate to see you eat the full value of that call. You're right, you should never pay for options just before earnings. That's when implied volatility (IV) is highest and you are paying a hefty markup as they are overpriced. If you wanted to play that earnings on the bullish side, you could have sold a put credit spread. You are taking advantage of the high IV by selling one contract at marked up value and buying a cheaper contract for protection. You cap your max gain, but it is a far better plan going into earnings. Also, it's easier to adjust the trade if it goes against you. I do enjoy watching your thread and feel you have a good handle on your picks. If you're net positive, keep doing what you're doing! Stay away from those derp plays - never enter a trade when you're drunk on success :D |

| sandjco 648 posts msg #150866 - Ignore sandjco |

2/22/2020 7:57:12 PM Thanks Xarlor! If I understand the "PUT CREDIT spread" using SPCE $33.87 as an example if I am bullish...I would then: SELL the MAR20 35P for $8 BUY the MAR20 30P for $5.60 My account would be credited $2.40 ($8 - $5.60) and I would assume SPCE needs to close at $35 or above for me to "win" $2.40 so that the Puts would be worthless? And if it goes against me...I would lose $2.40? Sorry, just trying to understand the rudimentary concept in a condensed manner. You are correct about the "drunk" trading tendencies... The "psychology" part of trading for sure is super challenging. The dangers being: - trading for the sake of "triggering" the trade - feeling like you have to have a trade every day/hour/minute - past success = guaranteed future gains therefore, when you are "hot" just go for it... - letting your guard down (didn't follow my 50% stop on ROKU coz my gains spoiled me) The silver lining of the ROKU debacle was it allowed introspection and I decided to close my long positions before the nasty Friday instead of "revenge" trading. As always, many thanks! |

| xarlor 639 posts msg #150871 - Ignore xarlor modified |

2/22/2020 10:13:25 PM You have the gist of it. SPCE is at an all-time high IV, so STO is the right play. Options pricing after-hours is always wonky. For that trade, I'm getting a $3.00 credit, max loss of -$200 and max gain capped at $300. Break even in this case would be $32.01 at expiration. Your broker will have a margin requirement of $500 for this trade (distance between the strikes) so keep that in mind if you start putting on lots of spreads. Selling spreads: Margin requirement ties up capital. Max loss is distance between the strikes minus credit received. Easier to adjust trades that go against you. Buying spreads: No margin requirement. Max loss is what you pay for the spread. Adjusting is a lot less effective. If you're serious about learning options, I highly recommend the free learning tracks at optionalpha.com. There are a lot, but the information after you go through all the videos is invaluable. It's worth your time to do a couple a day. |

| StockFetcher Forums · Stock Picks and Trading · Picks and Pans Since Jan 2020 | << 1 ... 4 5 6 7 8 ... 29 >>Post Follow-up |