| StockFetcher Forums · Stock Picks and Trading · A Newbie's Journey | << 1 ... 15 16 17 18 19 ... 48 >>Post Follow-up |

| sandjco 648 posts msg #139619 - Ignore sandjco |

11/29/2017 2:47:27 PM Yep...bailed today on XIV. SOXL took a nasty turn; couldn't see what the news... LOL...hope they got the real goods and not dentures shills!!!! Mind you, taking those dentures out may just provide a different "feel" to it! |

| sandjco 648 posts msg #139631 - Ignore sandjco |

11/30/2017 12:27:11 AM Sold LABU at $68.80; slight loss. All cash. Patiently waiting. |

| sandjco 648 posts msg #139755 - Ignore sandjco |

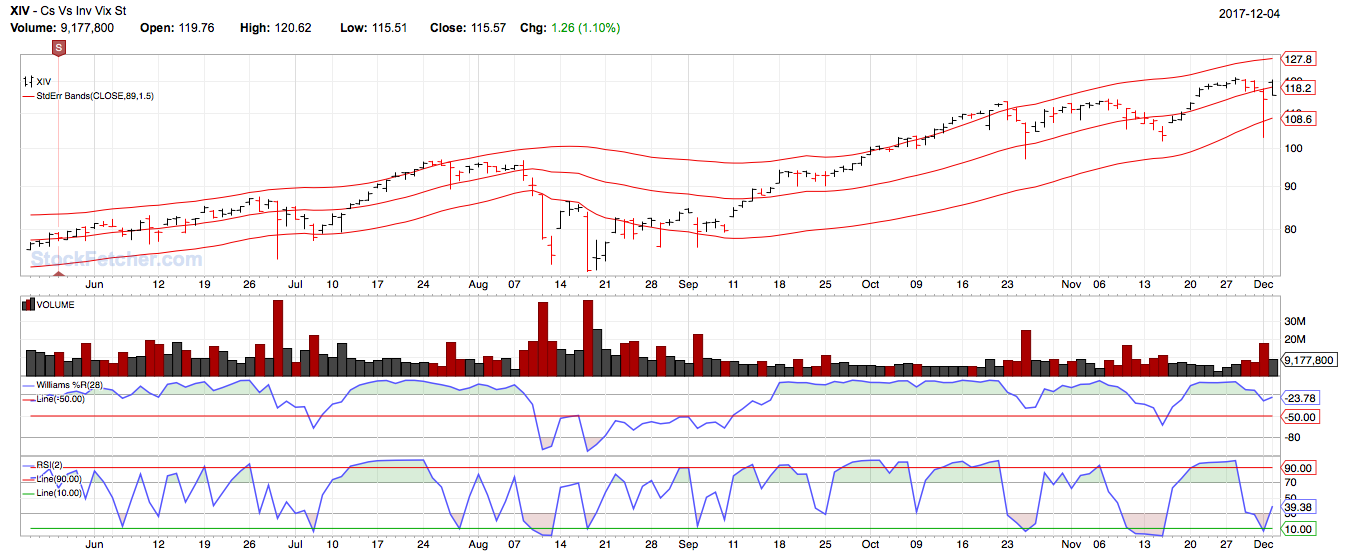

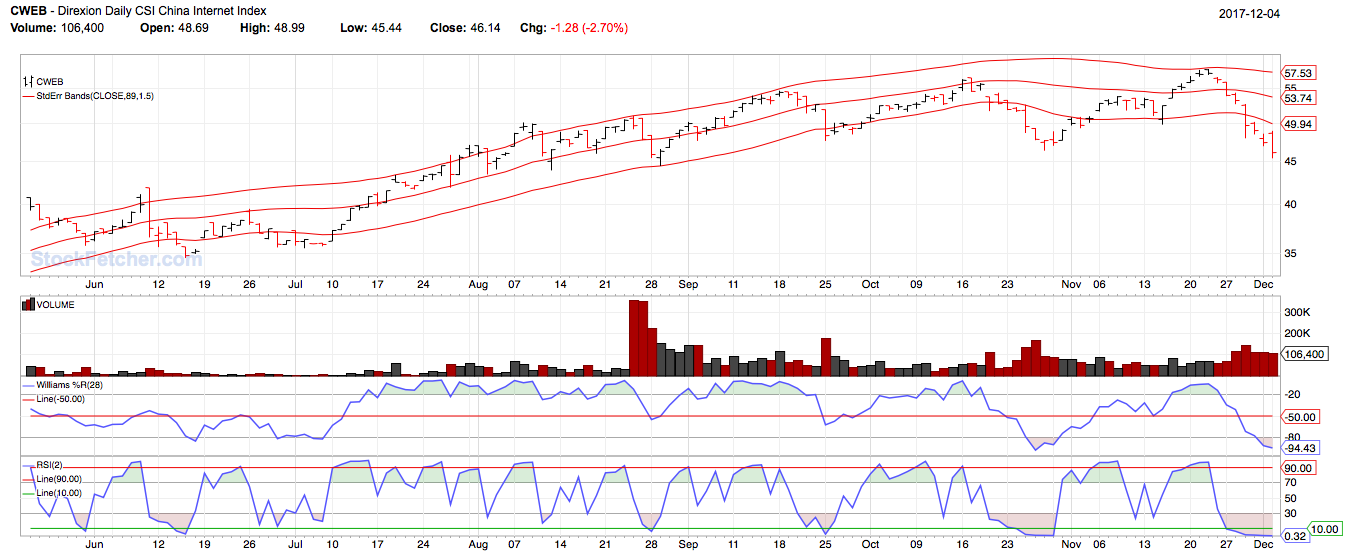

12/4/2017 2:49:52 AM picked up initial positions in: SOXL $140.71, XIV $114.31 and CWEB at $47.42. |

| sandjco 648 posts msg #139812 - Ignore sandjco |

12/5/2017 8:35:34 AM Haven't read the news on why these went schitt's creek!    Using ACB of $108ish for XIV and sold at $118.15...about 9% in about a month. |

| shillllihs 6,102 posts msg #139849 - Ignore shillllihs |

12/6/2017 12:35:47 AM I see you've picked up one of my secrets incorporating standard error bands. Just a warning, they only work in a bull market. |

| sandjco 648 posts msg #139861 - Ignore sandjco |

12/6/2017 11:56:49 AM @shills...yep, you are correct. I try to learn and adapt as I go along! I'm also not certain if there are really any "indicator" that would work 100% of the time in any situation. I'm trying to figure what I am ...a swinger or a hold till death do us part or a bump and chuck or all of them combined.... |

| shillllihs 6,102 posts msg #139863 - Ignore shillllihs |

12/6/2017 12:44:57 PM Standard error work great in a bull market as a buy and sell off lower line. I mean the best. Just accumulate below. But you also have to have a good exit filter on the way up. Basically you can play Xiv long and short. You're almost there. In a bear market or swing market, you can just short small amounts of Tmv or maybe go long. Usd. |

| shillllihs 6,102 posts msg #139875 - Ignore shillllihs |

12/6/2017 8:07:44 PM Well the toughest one actually should be the easiest and that's buy n hold. Long term horizon you will make good money and amazing money if you have unlimited funds to add on dips. Scalping is stupid and you will never get wealthy doing it. Too ez to make mistakes. Swing trading gives you the best of of both worlds, and if you learn it well you won't have to ride out those monthly swings. Swing trading in both directions or adding on dips in my opinion is the most profitable. |

| sandjco 648 posts msg #139951 - Ignore sandjco |

12/9/2017 10:43:05 AM Yep...I can see that; it is the execution that makes it a journey! SOXL is testing my patience. Added to XIV using EOD $123.75; made a new high. |

| sandjco 648 posts msg #140145 - Ignore sandjco |

12/16/2017 12:07:39 AM Added more to SOXL at $137.54 and CWEB at $47.60 using EOD prices. Wanted to add more to XIV...but looks like it may be time to sell half? |

| StockFetcher Forums · Stock Picks and Trading · A Newbie's Journey | << 1 ... 15 16 17 18 19 ... 48 >>Post Follow-up |