| StockFetcher Forums · · Shills Corner | << 1 ... 16 17 18 19 20 ... 101 >>Post Follow-up |

| Mactheriverrat 3,178 posts msg #142265 - Ignore Mactheriverrat |

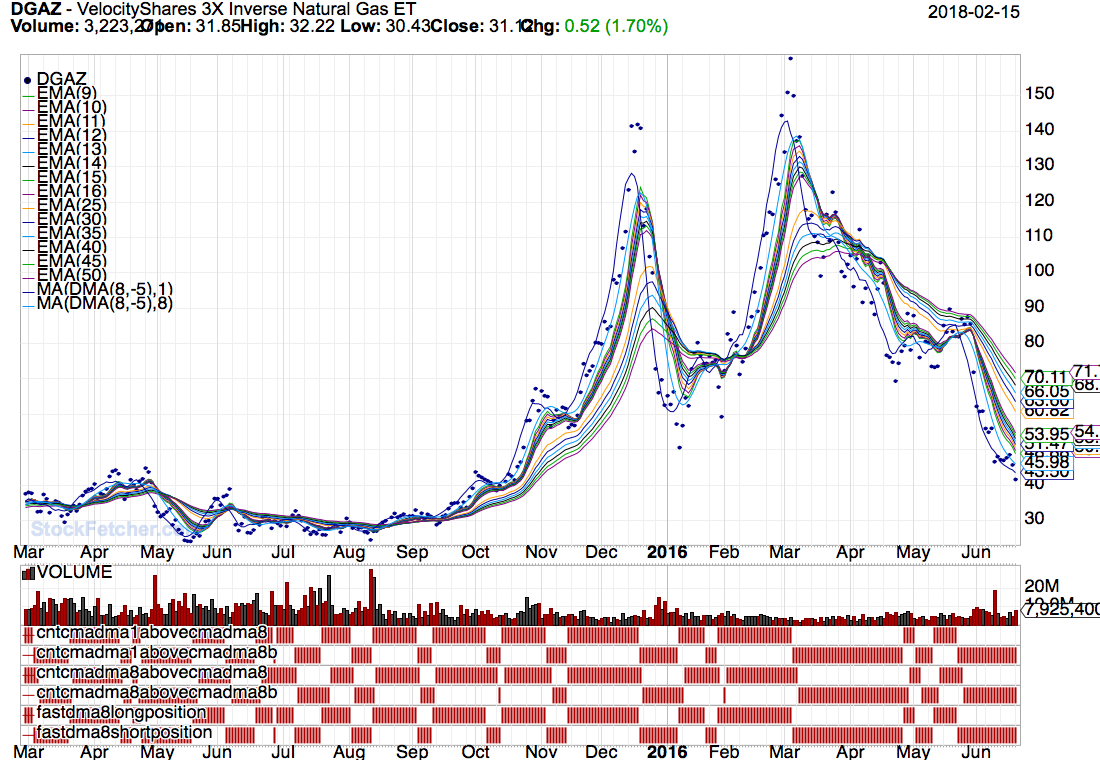

2/15/2018 4:17:27 PM There are some good Bullish entry points back then.    |

| Mactheriverrat 3,178 posts msg #142266 - Ignore Mactheriverrat |

2/15/2018 4:19:40 PM Ugaz - Could see a cross tomorrow - Just saying.  |

| davesaint86 726 posts msg #142271 - Ignore davesaint86 |

2/15/2018 8:34:50 PM Thanks for the warning. For a sideways choppy market I could follow the Above the Green Line method (price crosses above Slo Sto(5,1) 20 line and Sell above the 80 line or follow the Ira Epstein method (price crosses MA(18) is a buy and sell at the upper BB(18). http://stockcharts.com/public/1107832 or I also have my RSI4/RSI9/RSI30 strategy. Worst-case scenario can stay out of the market until it starts trending. |

| shillllihs 6,102 posts msg #142288 - Ignore shillllihs |

2/16/2018 2:21:01 PM Who wants to get in UGAZ early thinking there may be a gap up next week? Or it could just drop to 0. Come join Shills and the ever lovely, still very attractive Filipina wife at Sabatinos Italian Restaurant tonight at 8pm, for live music and great food. I’ll buy you a glass of fine Chianti with a side order of fava beans, thip thip thip... https://www.yelp.com/biz/sabatinos-restaurant-chicago-chicago |

| davesaint86 726 posts msg #142289 - Ignore davesaint86 |

2/16/2018 2:27:22 PM I jumped in UGAZ this morning with a small position. Let's think realistically. What is the chance of at least a 20% gain from the current price within the next six months? I'm guessing pretty high. I personally think within two weeks. |

| shillllihs 6,102 posts msg #142297 - Ignore shillllihs |

2/16/2018 8:05:31 PM Looks like gasl gasl already triggered so Ugaz next. Haven’t looked how linked they are. |

| pthomas215 1,251 posts msg #142298 - Ignore pthomas215 modified |

2/16/2018 8:34:04 PM i think they are very similar. it seems on a quick study that on a weekly basis UGAZ has a bit less of a movement than GASL. the word is long gas. gold was so confusing the past few days. sure seemed like JNUG was gonna head back up, then DUST looked perfect on a 4 hour chart. I made a rookie mistake...gonna be long DUST most likely on Tuesday. |

| davesaint86 726 posts msg #142299 - Ignore davesaint86 |

2/16/2018 9:11:24 PM |

| shillllihs 6,102 posts msg #142315 - Ignore shillllihs |

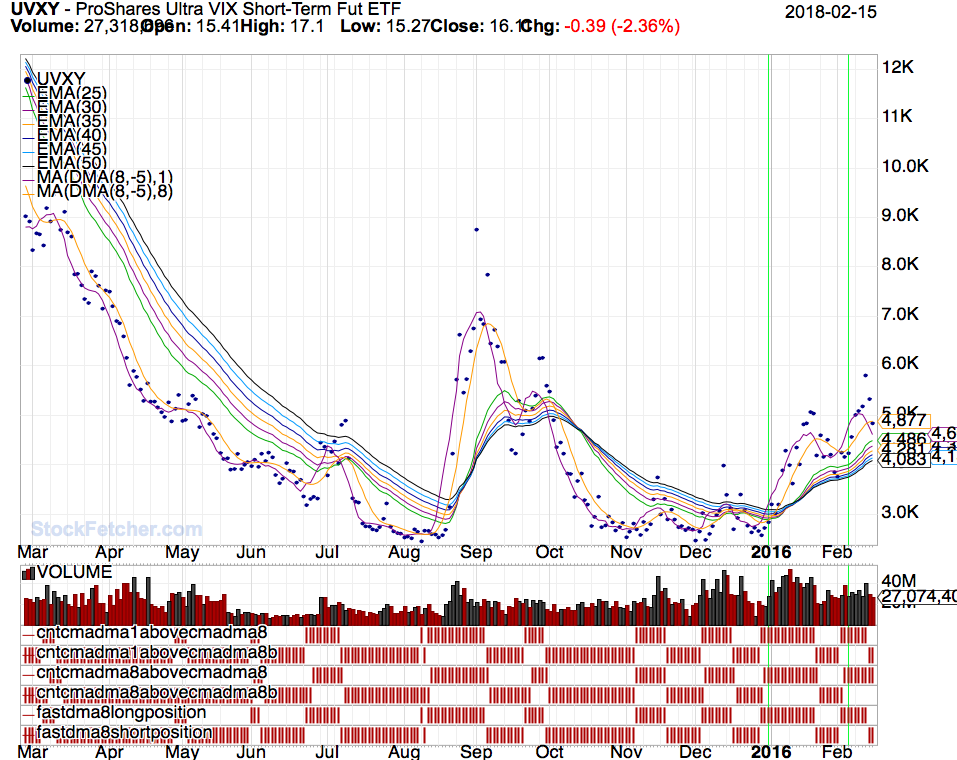

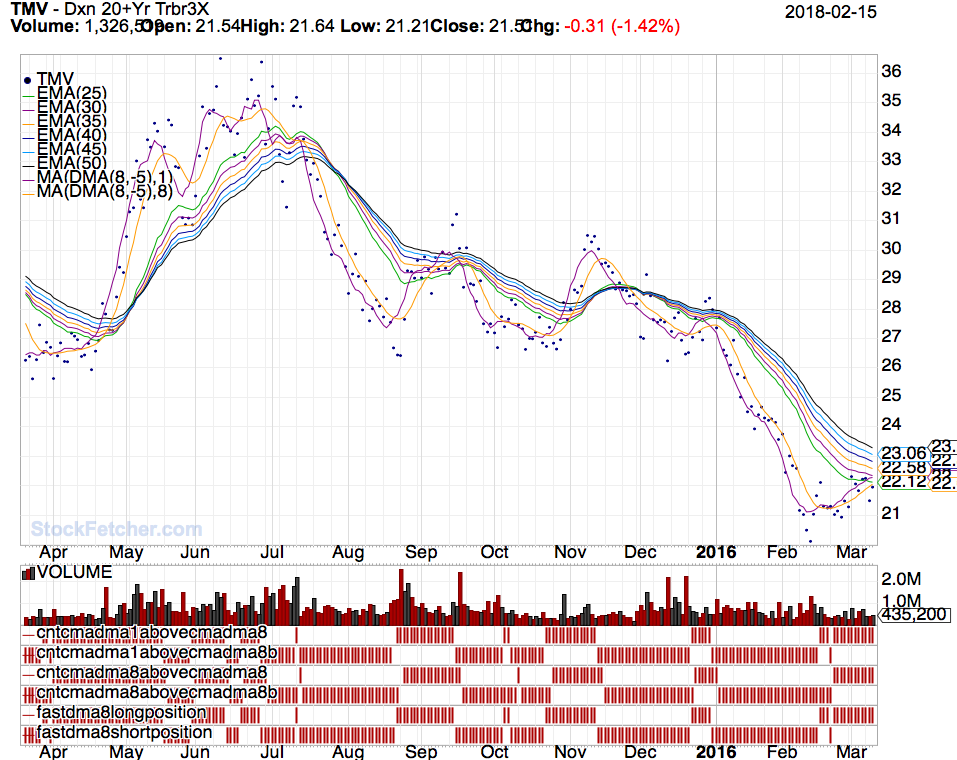

2/17/2018 1:38:08 PM A good shorting inverse filter. |

| shillllihs 6,102 posts msg #142357 - Ignore shillllihs modified |

2/20/2018 1:14:29 AM Looks like UGAZ up DGAZ down, but who knows. My system does it again, price above upper bands with a black candle, Dma coming in later as confirmation. But I’m still having trouble fully understanding. Can someone give me a definitive answer, I feel like I’m hallucinating. Dma can disappear from chart yes? So if we see a signal that disappeared, should we consider that a prelude to a reversal 100%? Anyway, I’m in Ugaz 90% and SPxl 10%. |

| StockFetcher Forums · · Shills Corner | << 1 ... 16 17 18 19 20 ... 101 >>Post Follow-up |