| StockFetcher Forums · Stock Picks and Trading · Follow The Money (Options) | << 1 ... 21 22 23 24 25 ... 31 >>Post Follow-up |

| BoCap 18 posts msg #141726 - Ignore BoCap modified |

2/2/2018 12:43:52 AM Also how do i post Screen Shots ? |

| 15minofPham 171 posts msg #141795 - Ignore 15minofPham |

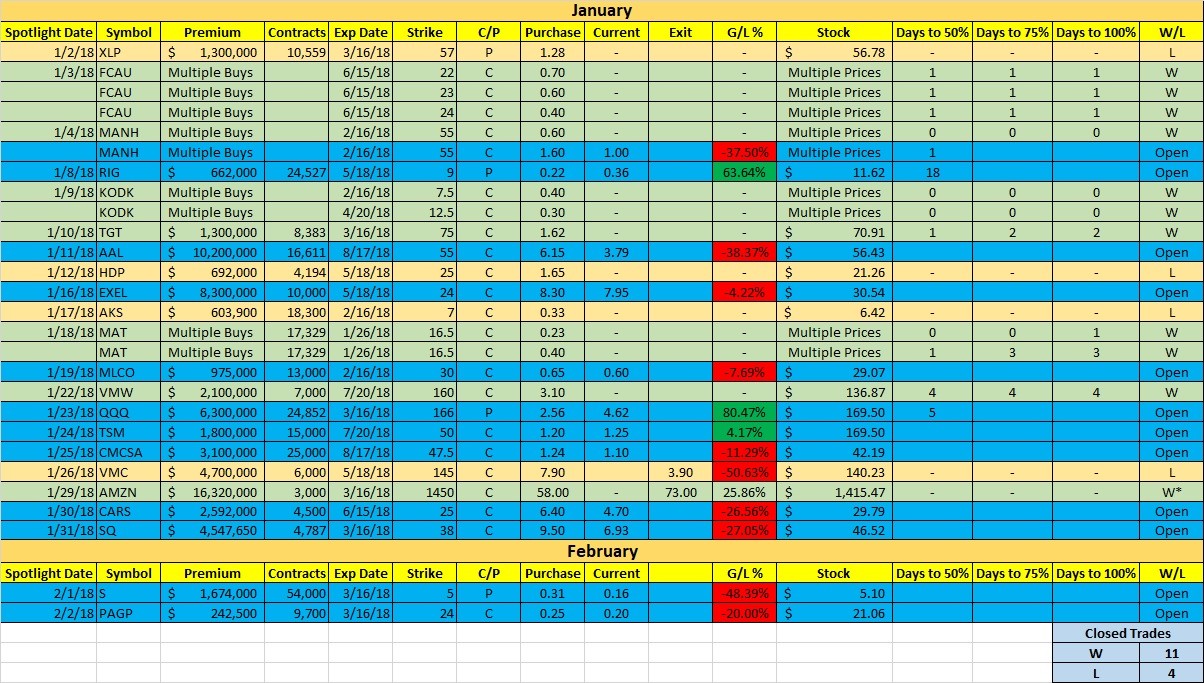

2/2/2018 11:28:04 PM Follow the Money Play of the Day - PAGP It was a tough decision between PAGP & WMT. The former "big" play pales in comparison in premium with the latter, but its relative volume was just too high to ignore. Premium of $242K on 9,700 of the 3/16/18 $24 Call for $0.25 with stock at $21.06. It's been beaten down this past week as with everyone else due to the violent pullback in the market. However, its total option volume today was 12.67 times its 90-day avg. Break even of $24.25 is nearly 18% from its closing price of $20.56. This would put it above its 52-week intraday high of $24.09. Total option volume Call/Put ratio was 100-0 and bullish order sentiment was 100%, easily above its 30-day average of 68%. Its total Puts volume today was only 8! If this doesn't indicate to you that it's not going anywhere but higher from here than I don't know how else to explain this to you. ------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------ Thursday's spotlight - S, $1.6 million, 54,000, 3/16/18 $5 Put $0.31, Stock $5.10 A rare occurrence today where the Put didn't pan out. S gained 5.10% after earnings which in turn cratered the Put premium to -48%, almost at the stop loss -50%. ------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------ The portfolio saw its fourth loss as VMC hit the 50% stop loss. Even though the expiration is still three months away, for tracking uniformity, rule states it must be sold at -50%. A huge error in not selling MLCO yesterday when it hit +50% came back to bite me hard. It dropped 4.09% eviscerating the gains to now a loss of -7.69% This is a great example to take PROFITS in a very weak tape. I had a hard time believing the QQQ $6.3 million hedge play on 1/23. After all, the market was humming along to yet another 52 week high. But as I mentioned in that post, you simply can't ignore this big of a hedge play. Somebody ALWAYS knows! The profit stands at 80% and a weak opening on Monday should easily help it to the automatic sell target of 100%. RIG 5/18/18 9 Put took 18 trading days to hit +50%, by far the longest, but it still has room to fall. However, there's only 17K in OI so the investor has sold some of his 24K contracts. I will sell if there's any market bounce. Might make it to +75%, but 100% looks difficult as its daily Stochs is below 9. DISCLAIMER: This is a paper trading portfolio. It is an experiment in detailing following of "smart" money.  |

| 15minofPham 171 posts msg #141867 - Ignore 15minofPham |

2/5/2018 9:42:19 AM Both QQQ & RIG Puts hit the auto 100% gain sell target. |

| Daniel Kotas 2 posts msg #141889 - Ignore Daniel Kotas |

2/5/2018 3:37:24 PM Hello guys, looking at SQ options with expiry on 2/16/18 and 3/16/18, the strikes 42 and 42,50 have really high OI, but on BOTH call and put side. Any idea what that might mean? I have a SQ C2/16/18 @3.75 just for the record. Thank you for response! |

| 15minofPham 171 posts msg #141917 - Ignore 15minofPham |

2/5/2018 10:48:11 PM Follow the Money Play of the Day - INTC Premium of $8.5 million on 40,000 of the 6/15/18 $48 Call for $2.14 with stock at $46.53. Smart money still pours it in, albeit with further out expiration in the face of this carnage. This is part of a spread where they sold the 2/16/18 46 Call. Be patient and only piggy back once market gives buy signal. You can get in at a lot cheaper price and your option will easily double if not triple after the inevitable face ripping rally. Total option volume Call/Put ratio was 80-20 and bullish order sentiment was 63%, inline with its 30-day average of 62%. ------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------ Friday's spotlight - PAGP, $242K, 9,700, 3/16/18 $24 Call $0.25, Stock $21.06 Became a one day sell casualty at -50% stop loss as it couldn't buy enough time until this intense selling is over. ------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------ PAGP became the 5th loss in the portfolio, but thankfully both the RIG & QQQ Puts hit our +100% target to help the record to 13-5. Nonetheless, all of the open positions are in red. Market needs to rally now or there will be a lot more casualties. DISCLAIMER: This is a paper trading portfolio. It is an experiment in detailing following of "smart" money.  |

| 15minofPham 171 posts msg #141918 - Ignore 15minofPham |

2/5/2018 10:53:42 PM Hi Dan, It's hard to tell without access to historical trades. I'm sure you know that unfortunately you're running out of time. If you can, I'd rolled it out to June. HTH Daniel Kotas 2 posts msg #141889 - Remove message 2/5/2018 3:37:24 PM Hello guys, looking at SQ options with expiry on 2/16/18 and 3/16/18, the strikes 42 and 42,50 have really high OI, but on BOTH call and put side. Any idea what that might mean? I have a SQ C2/16/18 @3.75 just for the record. Thank you for response! |

| BoCap 18 posts msg #141951 - Ignore BoCap |

2/6/2018 11:26:52 AM it is now 11:20 I spotted STZ with 2 big quantity orders , 1 at 9:43am and 2nd is at 10:14am. Both of them at the same strike and expiry date. it's a total of 2.9 million. What i'm seeing is how come the bid and ask spread is so widely apart ? Buying now is at 4.30 and selling is 3.10 ??? As of this moment the bid price is creeping up to 3.50 and ask at 4.00 ?? Any explanation ? and should i get in on this ? |

| 15minofPham 171 posts msg #141957 - Ignore 15minofPham |

2/6/2018 12:31:24 PM Bo, Looks like the 4000 4/20/18 240 Call $4.00 is the one to follow. That's a pretty aggressive buy considering the weakness of the market. It's now at $3.50. Might be a good time to piggy back on it since the price is lower. HTH |

| BoCap 18 posts msg #141979 - Ignore BoCap modified |

2/6/2018 9:44:35 PM Yes, but both of them are the same option with the same expiry and strikes, Its just they are 20 mins apart .. i would think they both are from the same institute or at least the same fat cat. So what did you mean when you're saying i should piggy back on the 4000 ( quantity ) ??? I'm sorry i'm lost... BTW you are Vietnamese right ? |

| 15minofPham 171 posts msg #141980 - Ignore 15minofPham |

2/7/2018 12:24:43 AM Follow the Money Play of the Day - CAT Premium of $3 million on 3,325 of the 5/18/18 $155 Call for $9.05 with stock at $152.70. The big cat was climbing non stop until it hit the big pull back branch. As cats do it landed on its feet or in this case the daily 100 MA. Today's +3.53% allowed it to climb back above the 50 MA. Break even of $164.05 is 4.88% from today's close of $156.41. Total option volume Call/Put ratio was 73-27 and bullish order sentiment was 66%, slightly higher than its 30-day average of 61%. ------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------ Monday's spotlight - INTC, $8.5 million, 40,000, 6/15/18 $48 Call $2.14, Stock $46.53 Showed a nice hammer at the 100 MA, but option dropped to -27%. ------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------ Sold MANH due to earnings tonight for a loss of -28%. Portfolio's record now is 13-6. Market needs to have a sustained rally as both AAL & SQ are above -40%, less than 10% away from our -50% stop loss.

DISCLAIMER: This is a paper trading portfolio. It is an experiment in detailing following of "smart" money. |

| StockFetcher Forums · Stock Picks and Trading · Follow The Money (Options) | << 1 ... 21 22 23 24 25 ... 31 >>Post Follow-up |