| StockFetcher Forums · General Discussion · Have we truly bottomed? | << 1 ... 3 4 5 6 7 ... 10 >>Post Follow-up |

| nikoschopen 2,824 posts msg #60204 - Ignore nikoschopen |

3/5/2008 10:42:11 AM I'm going out on a limb here and call for the market to be in a trading rage until the Fed Beige Book is released and thereafter profit-taking will send this market down. |

| petrolpeter 439 posts msg #60212 - Ignore petrolpeter |

3/5/2008 12:36:11 PM Looks like the Bond pits are seeing an intra-meeting cut from Bubbles Bernanke. |

| nikoschopen 2,824 posts msg #60218 - Ignore nikoschopen |

3/5/2008 12:57:51 PM The recent spike that has since fizzled was due to Ambac speculation. I ain't too sure Bernanke has any more believers in his emergency rate cuts to warrant one. |

| nikoschopen 2,824 posts msg #60220 - Ignore nikoschopen modified |

3/5/2008 1:23:23 PM 03/05/2008 13:21 *DJ Ambac To Stop Underwriting CDOs, Mortgage-Backed Securities 03/05/2008 13:21 *DJ Ambac Says Making Concurrent Offering Of Equity Units 03/05/2008 13:21 *DJ Ambac To Stop Underwriting CDOs, Mortgage-Backed Securities 03/05/2008 13:23 *DJ Ambac:Equity Offerings Aimed At Keeping Ambac Assurance AAA 03/05/2008 13:24 *DJ Ambac Doesn't Expect To Get 'Stable' Outlook From S&P, Moody's 03/05/2008 13:24 *DJ Ambac Says Making Concurrent Offering Of Equity Units 03/05/2008 13:24 *DJ Ambac To Stop Underwriting CDOs, Mortgage-Backed Securities 03/05/2008 13:26 *DJ Ambac: Could Do 'Significantly Reduced Busines Plan' At AA 03/05/2008 13:26 *DJ Ambac To Keep Working Closely With Regulators, Ratings Agencies 03/05/2008 13:29 *DJ Ambac To Keep $100M In Proceeds At Holding Co 03/05/2008 13:30 Ambac Financial Group, Inc. Announces Commencement of Simultaneous Common Stock and Equity Unit Offerings 03/05/2008 13:30 *DJ Ambac Fincl Group, Inc. Announces Commencement Of Simultaneous Common Stk And Equity Unit Offerings 03/05/2008 13:30 *DJ Ambac Fincl Starts Offering For At least $1B Worth Of Its Cmn Stk 03/05/2008 13:30 *DJ Ambac Fincl Starts Offering Of Equity Units 03/05/2008 13:31 *DJ Ambac To Offer $500M In Equity Units 03/05/2008 13:31 *DJ Ambac To Offer At Least $1B In Common Stock 03/05/2008 13:31 *DJ Ambac Fincl: Equity Units Offered At $50 Per Unit For $500M 03/05/2008 13:35 *DJ S&P Rtgs On Ambac Unaffected After Financing Announcement>ABK 03/05/2008 13:36 *DJ Fitch: Ambac's 'AA' Rtg Remains On Watch Neg Following Capital Announcement 03/05/2008 13:39 *DJ Ambac Shares Resume Trading, Drop 11% 03/05/2008 13:41 *DJ Fitch Sees Ambac Achieving Cap Level To Keep AA IFS Rating 03/05/2008 13:42 *DJ Fitch: Ambac Unlikely To Keep Cap Level To Support AAA IFS 03/05/2008 13:43 *DJ Fitch: Sees Affirming IFS AA If Ambac Raises Capital 03/05/2008 13:43 DJ US Stocks Shed Gains; Ambac Filing Disappoints 03/05/2008 13:44 DJ Ambac To Offer At Least $1B In Common Stock >ABK 03/05/2008 13:44 *DJ Fitch: Ambac Not Likely To Regain AAA Rating Until Subprime Risk Effectively Contained 03/05/2008 13:44 DJ Ambac Will Try To Raise $1.5B Via Equity Sales To Defend AAA 03/05/2008 13:44 DJ Ambac Doesn't Expect To Get 'Stable' Outlook From S&P, Moody's 03/05/2008 13:44 DJ Ambac Says Making Concurrent Offering Of Equity Units 03/05/2008 13:44 DJ Ambac To Offer $500M In Equity Units 03/05/2008 13:45 Fitch: Ambac's 'AA' Rating Remains on Watch Negative following Capital Announcement (Source: Dow Jones Newswire) What does all this exactly mean? Charlie Gasparino, who broke the Ambac bailout on CNBC, tells the Fast Money crew that the whole thing was a joke from day one. |

| danv83 44 posts msg #60237 - Ignore danv83 |

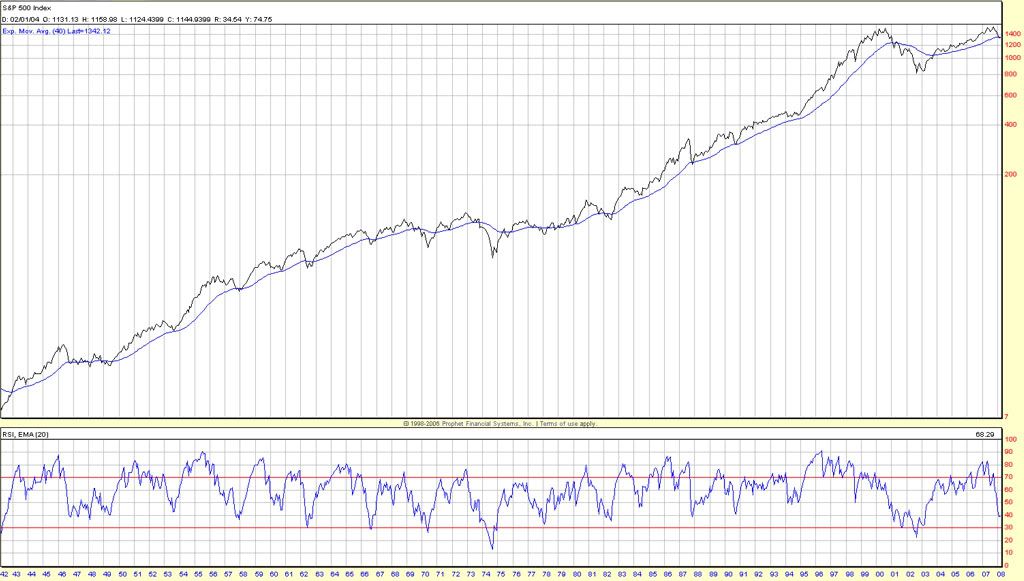

3/5/2008 10:10:34 PM Some thoughts... Here's a chart of the S&P 500 since around the dawn of nuclear energy (aka modern times). It's in log scale so you can compare the percentage moves to eachother. It is a monthly chart and there is an ema of 40 months, also shown is an rsi of 20 months.

It is easy to see that typically the monthly ema(40) is the support for the bottom of each "crash". Of the 16 or so major dips in this chart I see the monthly rsi(20) dipping below 40 - six times. In other words 1 out of 3 crashes have been brutal where as the other 2 have been pretty melow (index wise that is). So here we are, touching the monthly ema(40), touching 40 on the monthly rsi(20). In the history of the S&P 500 these are major support areas, and when they are broken through is when the big drops have hit. These are ballpark statistics here but on average a market crash lasts 6 months and drops an average of 30% from the year high. We went -20% and bounced up from there on Jan 23rd, now the market is in a tug of war of sorts. My personal take is that if SPY can't break below $110 ish in the next 2 months ( $110 would be on par with the average 30% retracement of most market crashes) then it would be safe to say that we've bottomed, particularly so if this monthly rsi(20) jumps back up above 50. The dollar reaching such a major low is disoncerting for sure, the US is in hot water - and a lot of stocks that aren't uniquely US are feeling the market panic. My guess is that once we pull off a bottom the best move would be to invest in stocks that are major global players which have been caught up in this mess but aren't at all part of the mess. |

| minocqua2 4 posts msg #60238 - Ignore minocqua2 |

3/5/2008 10:51:03 PM I think that the bottom is coming in the next two weeks, and it will be triggered by a burst in the gold prices as well as a small rebound in the US currency relative, primarily, to the Euro. |

| nikoschopen 2,824 posts msg #60240 - Ignore nikoschopen |

3/6/2008 2:23:56 AM The worst case scenario would be for the $SPX to retest the 2003 low. I personally think that we will at least go down to 1180-ish. But then again, I remember the pundits calling for a reversal since the market began to plunge in earnest back in 2001. Whenever there was a rally or two, they inevitably came out in droves to call their shot. That lasted well into 2003 as we all know when history proved them correct for once. |

| nikoschopen 2,824 posts msg #60400 - Ignore nikoschopen |

3/11/2008 5:18:36 PMEven so, I have no idea how this will mitigate the problems of foreclosure and the subprime mess that caused all this, let alone the gargantuan write-downs from various financial service outlets. Don't get deluded with other naive investors in thinking that the bottom is finally reached and the market can only go up from here. If you do, you would be sorely disappointed by this time next week. |

| zeezeetop 30 posts msg #60402 - Ignore zeezeetop |

3/11/2008 8:49:28 PM Agreed, sounds like Wall Street on welfare. |

| petrolpeter 439 posts msg #60404 - Ignore petrolpeter |

3/12/2008 4:11:02 AM Bubbles Bernanke is a mad man.We are going to see inflation like we have never seen before.What is going to stop our oh so trustworthy bank houses from using this easy money once again to load up on oil,gold.comod contracts?He has started an inflation fire just to try to warm up the housing market,madness.By the time any of this money brings an interest rate down a fraction of a percent,double digit inflation will wipe it out to the upside,for all of us. |

| StockFetcher Forums · General Discussion · Have we truly bottomed? | << 1 ... 3 4 5 6 7 ... 10 >>Post Follow-up |